The EUR/USD currency pair continued its upward movement on Wednesday. The previous day, there were some factors that suggested a new rise in the euro, but they were not particularly convincing. Mainly, only one report was published on Tuesday—the U.S. JOLTs job openings report—and it is not considered the most significant. It's important to note that this report is released with a two-month delay. In our opinion, there are much more relevant reports that provide insights into labor market conditions and employment/unemployment levels. However, we had previously warned that the market is currently inclined to buy the euro, and an upward correction is ongoing on the daily timeframe (TF). Consequently, the market is eager to buy on any pretext—or even without one.

On Wednesday, we witnessed this trend. Even before the day's most important report—the ISM Services PMI from the U.S.—was released, buying activity resumed. Interestingly, we cannot attribute this movement to Donald Trump since no official information came from him. While Trump caused market turmoil on Monday and confused many traders, not every market shift can be linked to the so-called "Trump factor." This is similar to explaining every inexplicable movement with the phrase "increased risk-on/risk-off sentiment in the market."

The Services PMIs from the Eurozone and Germany were fairly mediocre and did not justify another strong rise in the euro. However, it is evident on the daily timeframe that the price has only slightly corrected after a three-month decline. Therefore, the euro could continue to rise by at least 150-200 pips to make the correction proportionate to the preceding drop. We had cautioned that this correction could take some time. It will not resemble a sharp rally over a couple of weeks to the 1.06-1.07 level, followed by a quick return to the downtrend. Instead, the pair may spend several months in this corrective phase overall.

The trade war with China has resurfaced in the headlines, reminiscent of four years ago. Beijing and Washington have both imposed tariffs to maintain a stance of strength during ongoing negotiations. With equivalent tariffs in place, both parties can negotiate with greater confidence. While Trump was able to strike deals relatively easily with Colombia, Mexico, and Canada, it is unlikely that negotiations with China and the European Union will proceed as smoothly. As mentioned previously, economically weaker countries often feel compelled to comply with the U.S. because they risk facing greater losses by not following Washington's lead. In contrast, strong countries can't afford to blindly obey Trump, because doing so would effectively classify them as weaker nations. Consequently, Moscow, Brussels, and Beijing seek to maintain their power and status, which hinges on their ability to challenge Washington. Therefore, it is expected that negotiations with Beijing will be lengthy and challenging.

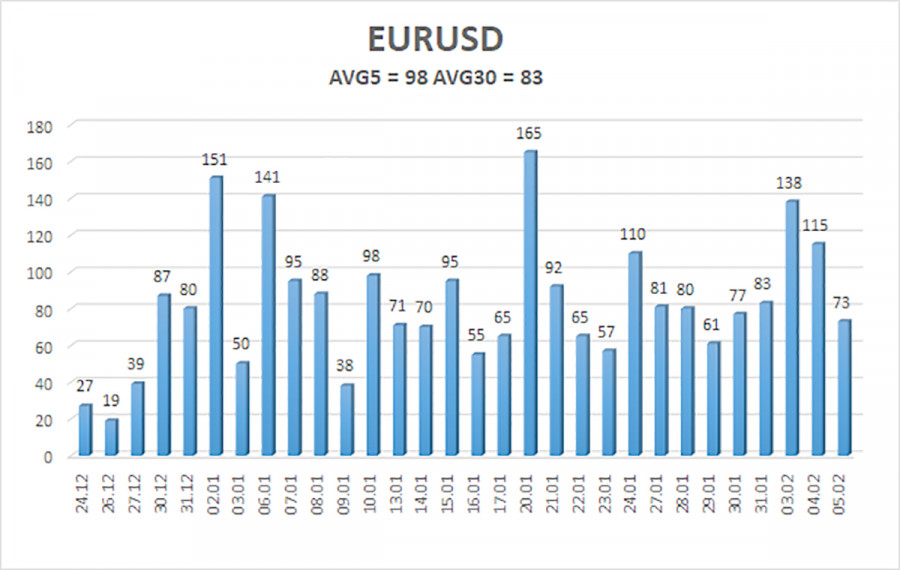

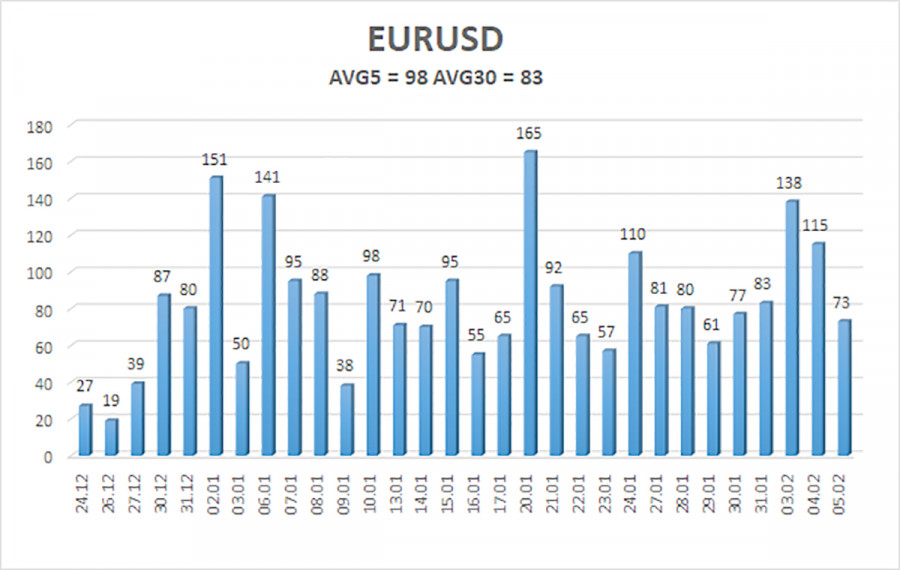

The average volatility of the EUR/USD currency pair over the past five trading days as of February 6 stands at 98 pips, classified as "moderate." We expect the pair to move between the levels of 1.0319 and 1.0515 on Thursday. The higher linear regression channel remains downward-sloping, indicating that the global downtrend persists. The CCI indicator entered the oversold zone but has begun a new ascent from the bottom.

Nearest Support Levels:

- S1 – 1.0376

- S2 – 1.0315

- S3 – 1.0254

Nearest Resistance Levels:

- R1 – 1.0437

- R2 – 1.0498

- R3 – 1.0559

Trading Recommendations:

The EUR/USD pair initially resumed its downward trend but then quickly reversed and moved upward. For the past few months, we have consistently maintained our expectation that the euro will decline in the medium term, and this outlook remains unchanged. The Federal Reserve has paused its monetary easing, whereas the European Central Bank is accelerating its own measures. Consequently, the U.S. dollar has no significant reasons to decline in the medium term, apart from occasional technical corrections.

Short positions are still relevant, with targets set at 1.0200 and 1.0193. However, the technical correction may persist for some time. If you are trading based on technical analysis, considering long positions is possible as long as the price stays above the moving average, with targets at 1.0498 and 1.0515. Nevertheless, any upward movement continues to be classified as a correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.