The EUR/USD currency pair showed relatively weak volatility last week, and the euro could not continue its growth within the current correction. Only the pound is rising for now, as it has some support from macroeconomic factors and the central bank. Meanwhile, the euro remains in a tough spot.

In the upcoming week, the euro can only hope for a miracle. There will be little macroeconomic data, and given the current stance of the European Central Bank and the Federal Reserve, it is extremely difficult to expect fundamental support. Additionally, Donald Trump's potential tariffs loom on the horizon. If they are implemented, the European economy will suffer even more. However, the U.S. economy will also take a hit, but the U.S. GDP has room to fall, while the EU GDP hardly does.

The new week will begin with the second estimate of the EU inflation report for January. This report was originally scheduled for release on Friday, but in any case, it holds little significance. Second estimates rarely differ from the first ones, so no significant market reaction is expected. On the same day, Germany will publish its business climate index, which, for obvious reasons, is also not to be taken too seriously.

On Tuesday, Germany will release its third GDP estimate for Q4. The German economy will undoubtedly shrink by 0.2% and decline by 0.2% for the entire year of 2024. Thus, another disappointing report on the European economy will not be news to the market.

On Wednesday, Germany will publish its "super important" consumer confidence index, which has been negative since March 2022. On Thursday, the eurozone will release a similar index, which has not exceeded zero in the last 10 years.

Only Friday might bring traders interesting reports. Germany will publish retail sales, the unemployment rate, and inflation for February. While euro-wide indicators are more crucial for the euro, data from the "locomotive of the European economy" is still significant and worth attention.

After listing all the key events of the upcoming week, it becomes clear that the euro will once again lack support from the EU. The euro can still rely only on corrective growth, which, as previously mentioned, may last for some time. Theoretically, German elections or new Trump initiatives could influence market sentiment in the coming days, but predicting the market's reaction to these events is nearly impossible. The euro may lean towards growth in the coming weeks, but from our perspective, only to fall even harder afterward. We still expect the pair to approach price parity or drop below it.

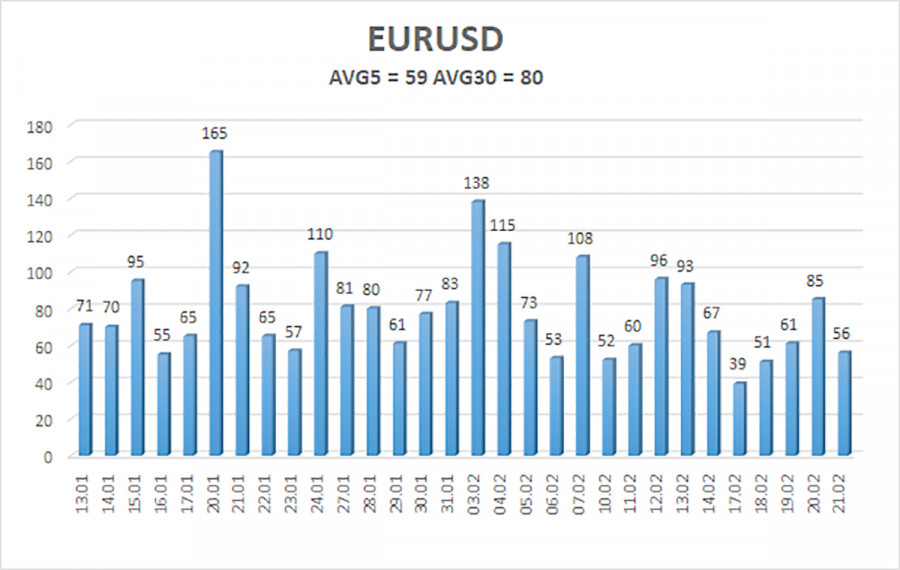

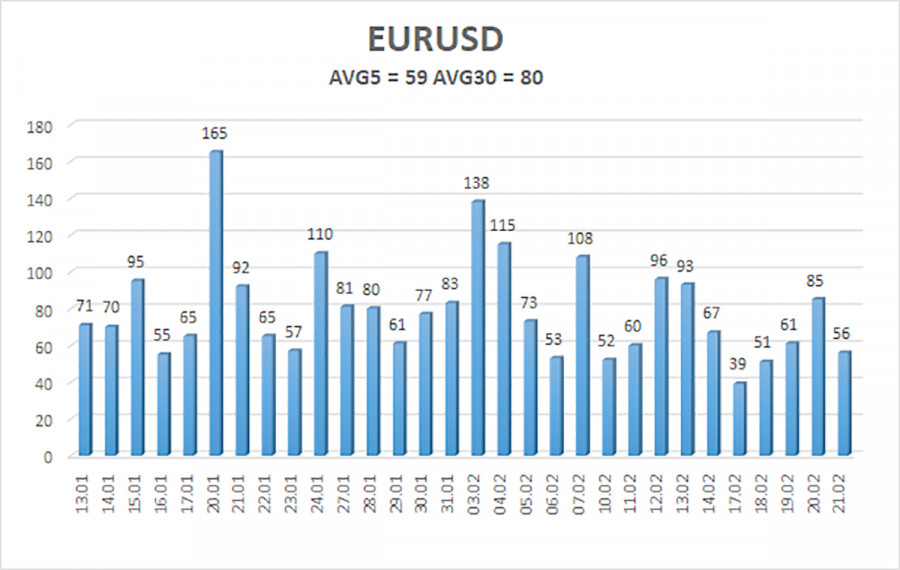

The average volatility of the EUR/USD currency pair over the past five trading days, as of February 24, is 59 pips, which is classified as "moderate." We expect the pair to move between 1.0402 and 1.0520 on Monday. The long-term regression channel remains downward, indicating that the global downtrend remains intact. The CCI indicator recently entered the oversold zone, triggering a new upward move from the bottom.

Nearest Support Levels:

S1 – 1.0437

S2 – 1.0376

S3 – 1.0315

Nearest Resistance Levels:

R1 – 1.0498

R2 – 1.0559

R3 – 1.0620

Trading Recommendations:

The EUR/USD pair continues its upward correction. In recent months, we have consistently stated that we expect the euro to decline in the medium term, and so far, nothing has changed. The dollar still has no fundamental reasons for a medium-term decline, except for Donald Trump. Short positions remain much more attractive, with initial targets at 1.0376 and 1.0347. However, the pair is currently in a flat phase, and the technical correction may continue for some time. If you trade based purely on technical analysis, long positions can be considered if the price is above the moving average, with targets at 1.0498 and 1.0520. Any upward movement is still classified as a correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.