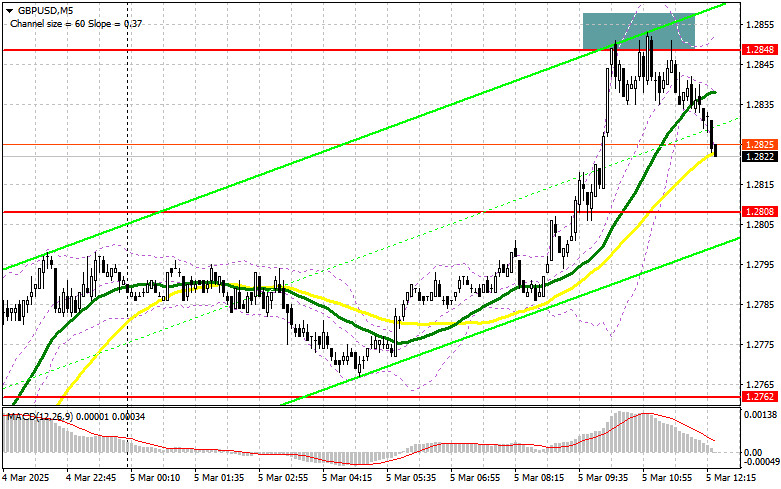

In my morning forecast, I focused on the 1.2848 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A rise and false breakout at 1.2848 provided an excellent selling opportunity, leading to a drop of over 30 points. The technical outlook for the second half of the day has been adjusted.

Long Position Strategy for GBP/USD

A slowdown in activity in the UK services sector acted as a reality check for pound buyers, who have been aggressively pushing the pair higher even at current highs, leading to a GBP/USD correction. In the second half of the day, buyers may face additional challenges in the form of strong ADP employment data for February and ISM Services PMI.

If these reports exceed expectations, the pound may fall toward the 1.2808 support, where I plan to enter long positions. A false breakout at this level will be an ideal signal to buy GBP/USD, targeting a recovery toward the 1.2848 resistance.

A break and retest of 1.2848 from above will confirm another buying opportunity, with an upward target at 1.2888, further reinforcing the bullish market trend. The final target is 1.2919, where I plan to take profits.

If GBP/USD declines further and there is no buyer activity at 1.2808, selling pressure will increase. In this case, I will only enter long positions after a false breakout at 1.2766. If the pound continues to decline, my last-resort long entry will be at 1.2721, targeting a 30-35 point rebound within the day.

Short Position Strategy for GBP/USD

Sellers made an attempt, and overall, it worked out quite well, especially given the bullish market environment. The focus now shifts to defending the 1.2848 resistance, as only strong ADP employment data can restore pressure on GBP/USD.

A false breakout at 1.2848, similar to the morning trade setup, will create a short-selling opportunity, targeting a drop toward 1.2808 (intermediate support).

A break and retest of 1.2808 from below will trigger stop-loss orders, opening the door for a further decline toward 1.2766, where moving averages, currently supporting bulls, are located. The final bearish target is 1.2721, where I will take profits.

If demand for the pound remains strong in the second half of the day, and sellers fail to act at 1.2848, the pair will likely continue rising. In this case, I will postpone short positions until the 1.2888 resistance test, where I will sell only after a failed breakout. If the pound does not decline from this level, I will consider selling at 1.2919, targeting a 30-35 point correction.

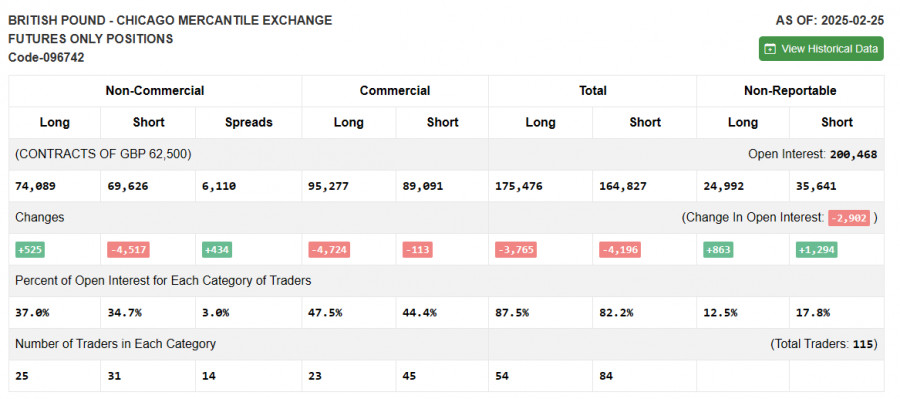

COT (Commitment of Traders) Report Analysis

The COT report from February 25 showed a minimal increase in long positions and a decline in short positions. The balance is shifting further in favor of buyers, suggesting continued growth for GBP/USD.

Considering positive developments in Ukraine conflict resolution and relatively stable UK economic data, buyers remain interested in the British pound.

The latest COT report shows that non-commercial long positions increased by 525, reaching 74,089, while non-commercial short positions fell by 4,517, to 69,626. This widened the gap between long and short positions by 434.

Indicator Signals

Moving Averages

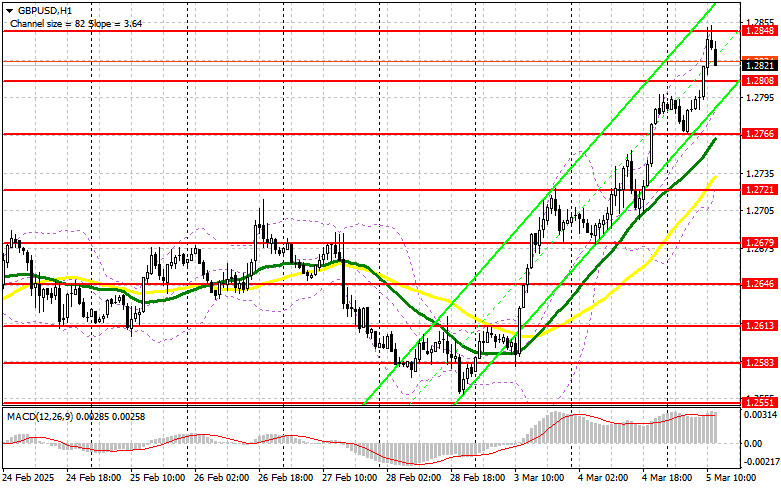

The price remains above the 30 and 50-day moving averages, signaling further bullish momentum.

Note: The author uses hourly (H1) moving averages, which may differ from the daily (D1) moving averages.

Bollinger Bands

If the price declines, the lower boundary of the indicator at 1.2721 will serve as support.

Indicator Descriptions

- Moving Average (MA): Identifies the current trend by smoothing out volatility and noise.

- 50-period MA (marked in yellow on the chart).

- 30-period MA (marked in green on the chart).

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period.

- Slow EMA – 26-period.

- SMA – 9-period.

- Bollinger Bands: 20-period.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions: The total number of open long positions held by non-commercial traders.

- Short non-commercial positions: The total number of open short positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.