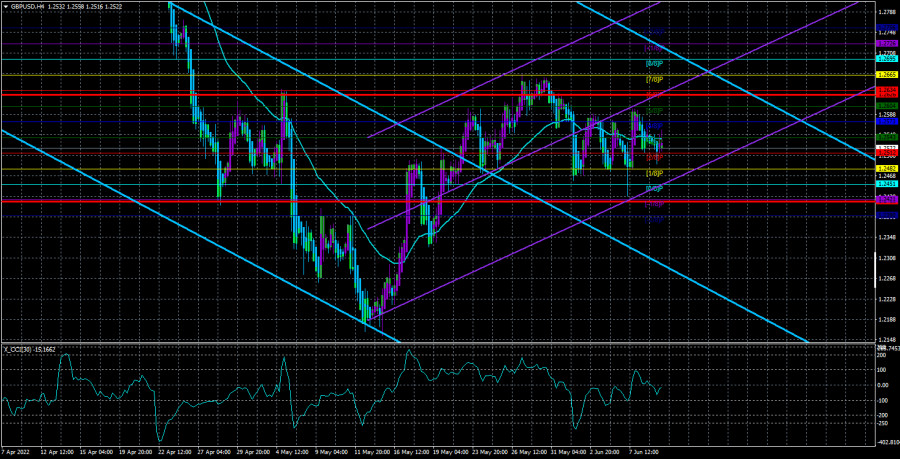

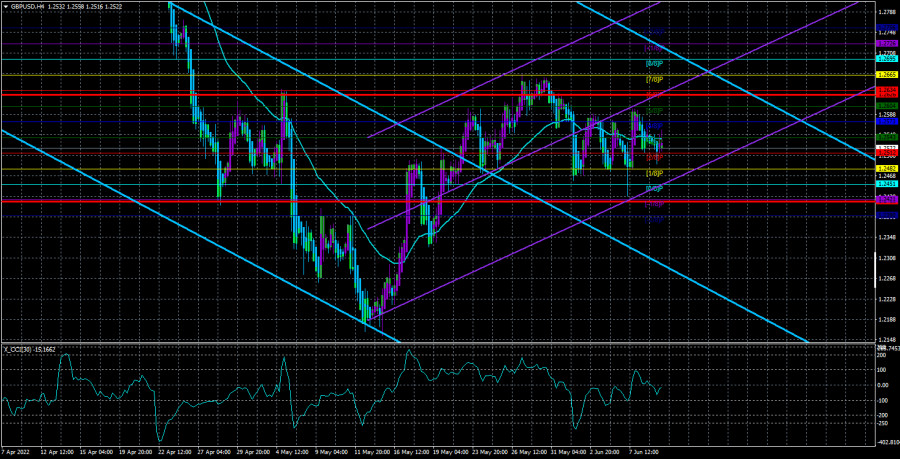

The GBP/USD currency pair continued to ride on a "swing" on Wednesday and Thursday. We have already said in our recent articles that the pair is in the side channel, which is much less visible on the 4-hour TF than on the younger ones. Nevertheless, even on the 4-hour timeframe, it is noticeable that in recent weeks the pair regularly overcomes the moving average line, which just indicates the absence of a trend. In fairness, it should be noted that there were no macroeconomic events in either the UK or the US this week. That is, traders had nothing to react to. However, for the sake of the same fairness, it should be pointed out that important statistics were published in the States last Friday, but it did not help the pair to resume the trend movement. Thus, it seems that we were right when we suggested the following a few days ago: the market adjusted the pairs within the framework of a long-term downward trend, then adjusted it against the correction itself, and now simply does not know what to do next.

To continue buying the pound sterling, one technical factor is already missing, since the pair has already adjusted upwards. There are also not enough grounds for new purchases of the US currency, since the market has long been aware of the Fed's plans to raise rates in 2022-2023. Therefore, it could work out this factor in advance. The geopolitical background in recent weeks has narrowed to "just fighting" in Ukraine. All possible sanctions that could be imposed against Russia have already been introduced. It remains for the European Union to completely abandon oil and gas, but even this decision is not far off. The market experienced a shock associated with the outbreak of the military conflict in Eastern Europe and its first consequences on the global economy. And now everything is going according to its script. Inflation continues to rise, prices continue to rise, oil is rising, gas is rising, stock markets are falling, and the cryptocurrency market is teetering on the verge of a new collapse. Thus, it remains only to wait for the continuation of this "madness".

Inflation in the US may accelerate by the end of May.

In principle, the key topic for the markets now remains the topic of inflation. And it doesn't even matter where exactly. It grows equally vigorously in almost all countries of the world. Recently, US Treasury Secretary Janet Yellen admitted her mistake when she said that inflation would be temporary. Recall that Christine Lagarde and Jerome Powell said the same thing. As you can see, they were all wrong, and all the forecasts that were given a year ago could have been safely thrown into the trash a few months ago. Now the Bank of England openly predicts maximum inflation of 10.25% in 2022. This means that in reality, it may amount to 12%. Jerome Powell openly admits his mistake regarding his position on inflation and says that "the Fed may have had to act earlier." The head of the Federal Reserve Bank of Cleveland, Loretta Meister, says that inflation in the States has not yet reached its peak, although last month it still slowed by 0.2% in annual terms. That's exactly what we've been talking about lately: one 0.2% slowdown could just be an accident. The report for May will be released today, and we will be able to make sure whether this is an accident or not? We believe that a significant decline in the consumer price index should not be expected. And this means that the Fed is simply obliged to continue raising the rate, with no pauses in September or October. The same applies to the Bank of England since there is not a single hint of a slowdown in inflation in the UK at all. Prices continue to rise, yesterday it became known that gasoline prices have already risen to 2.2% and showed the maximum daily increase over the past 17 years. And if gasoline prices rise, then prices rise for everything.

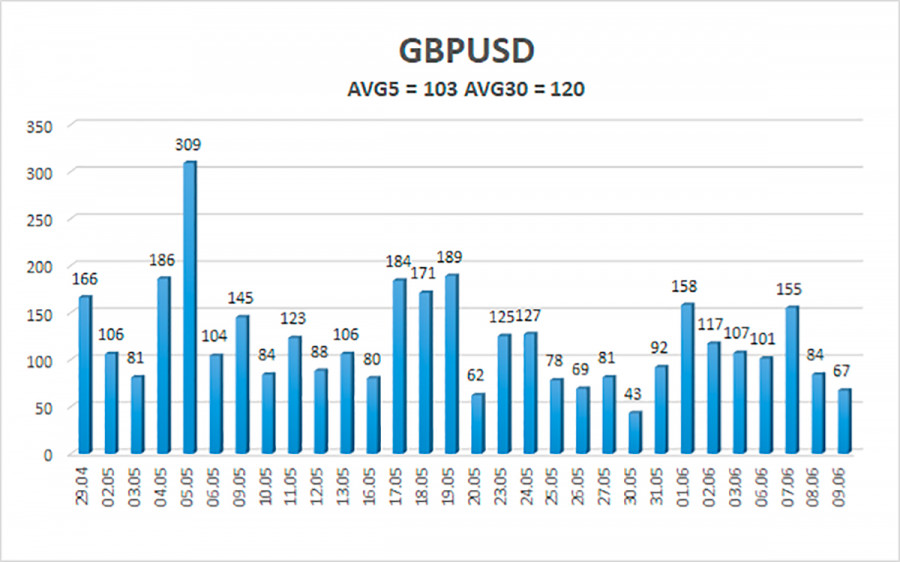

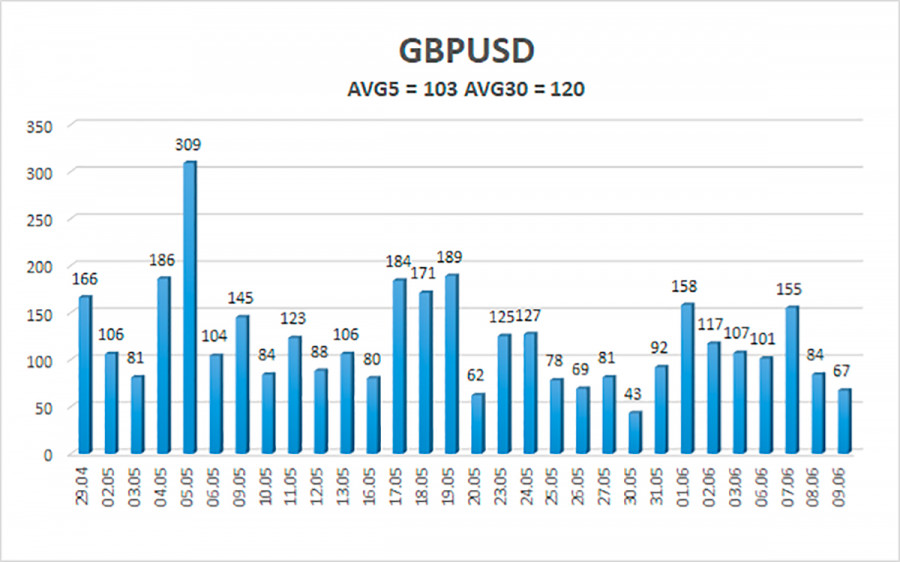

The average volatility of the GBP/USD pair over the last 5 trading days is 103 points. For the pound/dollar pair, this value is "high". On Friday, June 10, thus, we expect movement inside the channel, limited by the levels of 1.2419 and 1.2626. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.2512

S2 – 1.2482

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2543

R2 – 1.2573

R3 – 1.2604

Trading recommendations:

The GBP/USD pair has fixed below the moving average line on the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2482 and 1.2451 until the Heiken Ashi indicator turns up. It will be possible to consider long positions again if the price is fixed above the moving average with targets of 1.2604 and 1.2626. At this time, the pair continues to be in the flat and "swing" mode.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.