Asian stocks and US futures plunge amid Trump's new tariffs

Global financial markets started the week with a sharp decline, with Asian bourses falling on Monday and European and US futures under pressure. The reason is new tariff sanctions imposed by former US President Donald Trump on Canada, Mexico and China. The measures have heightened concerns about a potential escalation of the trade conflict, which could hit global economic growth.

Dollar rises, currencies fall

The US currency has shown confident strengthening amid recent events. In offshore trading, the dollar has soared to record highs against the Chinese yuan, reached its highest since 2003 against the Canadian dollar and set a new peak against the Mexican peso not seen since 2022.

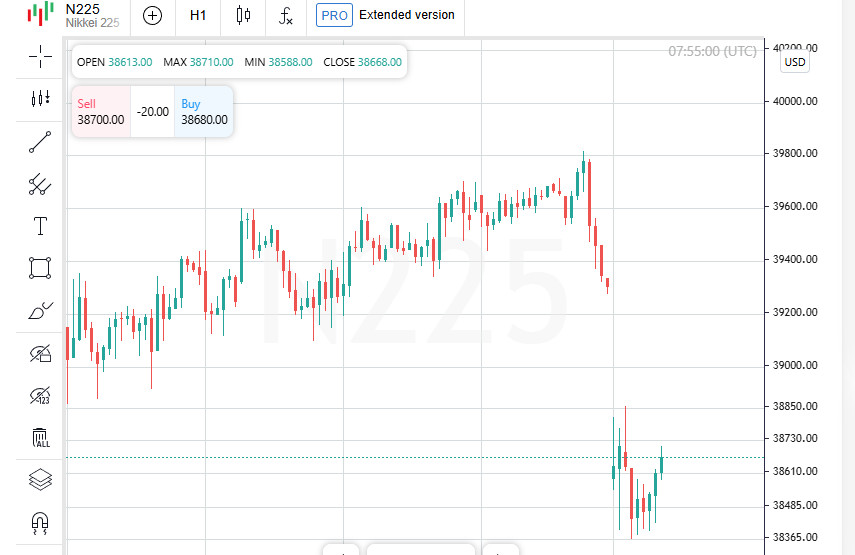

Stock market crash: Asia in the red

Asian markets reacted to the news with a sharp decline. Japan's Nikkei index (.N225) fell by 2.9%, while Australia's index (.AXJO), often considered an indicator of the Chinese economy, lost 1.8%.

In Hong Kong, where trading resumed after the Lunar New Year, Chinese stocks also showed negative dynamics, falling by 1.1%. Continental China has not yet responded to the changes — trading on its exchanges will begin on Wednesday.

Panic in Europe and the US

Futures on the largest pan-European index STOXX 50 fell by 2.7%, while US futures on the S&P 500 fell by 2%. Investors fear a further deterioration in relations between the world's largest economies.

Trump explained new tariffs by migrants

Trump announced new tariff restrictions over the weekend. According to his decrees, Canada and Mexico will face 25% tariffs, and China — 10%. The politician explained this step by the fight against illegal migration.

Retaliatory measures were not long in coming

Canada and Mexico immediately announced their intention to introduce retaliatory tariffs on American goods. In turn, China promised to challenge Trump's decisions in the WTO, which could lead to a protracted trade standoff.

The new tariffs are set to go into effect at 12:01 PM ET (05:01 GMT) on Tuesday.

Trade war could be catastrophic, economists warn

Donald Trump's latest moves could be the first step toward a full-blown trade war that could wreak havoc on global markets and send inflation soaring in the US. Capital Economics chief economist Paul Ashworth says the impact on the US economy could be far worse than previously thought.

"We had expected inflation pressures, but US price growth could now be both faster and stronger than we initially expected," Ashworth said.

Recession Around the Corner? Growth at Risk

The economic impact of the new tariffs is worrying analysts. According to calculations by EY, led by chief economist Greg Daco, Trump's policies could reduce US GDP growth by 1.5 percentage points in 2024. Moreover, the economies of Canada and Mexico could face recession, while the US could face stagflation, that is, a combination of economic decline and high inflation.

Barclays also released its forecast, according to which retaliatory measures from China, Canada and Mexico could cost the US stock market 2.8% of S&P 500 company profits.

Markets are in turmoil: the dollar strengthens, currencies fall

The US dollar continued to rise amid trade turmoil, demonstrating strong strengthening against key world currencies.

- In offshore trading, the dollar rose by 0.8%, setting a new all-time high of 7.3765 yuan;

- Against the Mexican peso, the American currency strengthened by 2.8% at once, reaching 21.2547 pesos, which is a record since March 2022;

- The Canadian dollar also suffered, with the US dollar up 1.4% to $1.4755 CAD, its first since 2003;

- The euro slipped 2.3% to $1.0125, its lowest since November 2022.

Is Europe the Next Target?

The concerns have been heightened by Donald Trump's statement over the weekend. The politician made it clear that tariffs against the European Union are next in line. If implemented, the pressure on the global economy will only increase, and stock markets could face even deeper shocks.

Against this backdrop, analysts warn that the developments could lead to a global economic downturn, higher prices for American consumers, and a weakening of the US position on the world stage.

The economic world is frozen in anticipation as markets brace for the possible consequences of a new round of trade confrontation.

Markets under pressure: bonds rise, bitcoin falls

Trade tensions caused by Donald Trump's new tariffs continue to affect global financial markets. The yield on two-year US Treasury bonds jumped 3.6 basis points, reaching 4.274%, which was a weekly high. The rally comes as investors worry that higher inflation from new tariffs could force the Federal Reserve to delay interest rate cuts.

Japan's debt market also reacted, with two-year Japanese bond yields rising to their highest since October 2008.

Cryptocurrencies also fell amid the market turmoil, with Bitcoin falling to $91,439.89, a three-week low.

Oil prices rise as markets weigh risks

While stock and currency markets are in turmoil, commodities are rising. Oil prices have risen as investors try to gauge the impact of the tariff war on global energy supply and demand.

- U.S. WTI crude rose 1.9% to $73.89 a barrel;

- Brent crude gained 1% to $76.39 a barrel.

Experts fear that new trade barriers could slow global growth, which in turn could impact oil demand in the coming months.

Stock markets continue to fall

US stock indices remain under pressure. In the Asian session, Nasdaq futures fell by 2.35%, while S&P 500 futures fell by 1.8%. Investors continue to dump risk assets amid uncertainty and the risk of an escalation in the trade conflict.

Canada, Mexico and China respond

The political reaction to Trump's decision was immediate. Canadian Prime Minister Justin Trudeau announced that the government was preparing retaliatory tariffs on US goods, which will take effect on Tuesday.

Mexican authorities also said they would take retaliatory steps. The country's president, Claudia Sheinbaum, promised to reveal details on Monday.

Beijing Prepares 'Countermeasures'

China, which has been the target of repeated US trade attacks, has signaled its readiness to take tough retaliatory measures. Chinese government officials have stressed that US consumers could feel the impact of a new wave of tariffs.

Amid rising tensions, global markets remain highly volatile, with investors watching closely. Will the world be headed for another global trade war? The big question in the coming weeks.

Markets Shocked: Tariff Uncertainty Deepens Crisis

Financial markets continue to tremble, with uncertainty over how long and how much tariffs will last creating a new wave of instability. Investors have already faced major turmoil after the emergence of China's DeepSeek AI model, which has dealt a blow to shares of leading tech giants. Now, with a trade war, inflation risks, and weakening emerging market currencies added to the mix, investors are rethinking their strategies.

Trump's Vague 'Pain': Who Will It Hit Harder?

Donald Trump has promised Americans that the tariffs will cause "some pain," but it's still unclear who will feel it most: China, Canada, Mexico, or the United States itself. Experts warn that the measures could lead to lower corporate profits, higher inflation, and a change in expectations for Fed rates.

If inflation in the United States accelerates, the Federal Reserve may abandon its planned monetary easing. This, in turn, will strengthen the dollar and weaken the currencies of trading partners such as the Canadian dollar and the Chinese yuan.

Canada to retaliate with massive tariffs worth $155 billion

Otawa is not going to let the blow go unanswered. Canadian authorities have announced the introduction of countermeasure tariffs worth $155 billion.

- Tariffs on American goods worth $30 billion will go into effect on Tuesday;

- The remaining $125 billion will come into effect in three weeks.

FX Markets: Dollar Rising, Yuan and Peso Under Pressure

FX markets are already reacting to the trade standoff:

- Yuan Weakens to Record 7.3765 in Offshore Trade;

- Canadian Dollar Falls to Over 20-Year Low;

- Mexican Peso Weakens 2% as Dollar Gains.

JPMorgan analysts estimate that if the U.S. does impose 25% tariffs on Mexican goods, the peso could lose up to 12% of its value, one of the biggest declines in emerging market currencies in a decade.

Euro Collapses, Stocks at Risk of Selloff

Emerging market currencies aren't the only ones under pressure. The euro has fallen more than 1%, hitting a two-year low.

Analysts are warning of a potential selloff in stocks and other risky assets.

Morgan Stanley experts say that if the new tariffs remain in place for several months, the U.S. stock market could face a major selloff. However, they believe that different sectors of the economy will react to the situation differently.

Amid this uncertainty, markets remain extremely tense, and investors are waiting for further developments in the trade war.

S&P 500 on the verge of sharp fluctuations: what's next?

Despite the ongoing tension, the S&P 500 index remains near all-time highs. However, analysts warn that the market could face fluctuations in the range of 3-5% in either direction in the near future. In their research, Evercore ISI strategists emphasized that uncertainty about tariffs could trigger both strong sell-offs and unexpected rebounds.

Earlier, Barclays calculated that new tariffs could reduce the total profit of S&P 500 companies by 2.8%. This takes into account not only the direct costs of tariffs, but also potential retaliatory measures from Canada, Mexico and China.

Trump reserves the right to tighten tariffs

According to the published decree, Trump reserves the right to expand the list of goods subject to duties, as well as to raise rates if foreign countries decide to take retaliatory steps. This increases investor concerns, as the trade war may enter a protracted phase, causing an even greater blow to the global economy.

Economists warn: inflation in the US will accelerate

Goldman Sachs experts analyzed the impact of tariffs on the American economy and came to the conclusion that:

- Core inflation in the US will grow by 0.7%;

- Economic growth will decrease by 0.4% of GDP.

These forecasts confirm the opinion of other analysts: if inflation accelerates, the Federal Reserve is unlikely to rush to cut interest rates, which investors had previously counted on.

The euro is under pressure, and rates may remain high longer

Amid these events, the euro continues to weaken. European Central Bank spokesman Klaas Knot said the new tariffs would likely fuel inflation in the US, forcing the Fed to keep rates high. This could weaken the euro as the interest rate differential between the US and EU widens.

The Fed may not cut rates in the next 12-18 months

Experts warn that if tariffs do indeed lead to higher inflation, the Fed simply won't be able to afford to cut rates in the next 12-18 months.

Paul Ashworth, chief North American economist at Capital Economics, said the window for monetary easing has "slammed shut." That's bad news for the stock market, as the expectation of rate cuts has been one of the key drivers of growth.

What's next? Markets await new decisions

Markets will be watching in the coming days to see how tough Canada, Mexico, and China will be in response. If the trade conflict takes a worst-case scenario, financial markets could face a major sell-off and the global economic outlook could face new recession risks.