Analysis of Trades and Trading Tips for the Japanese Yen

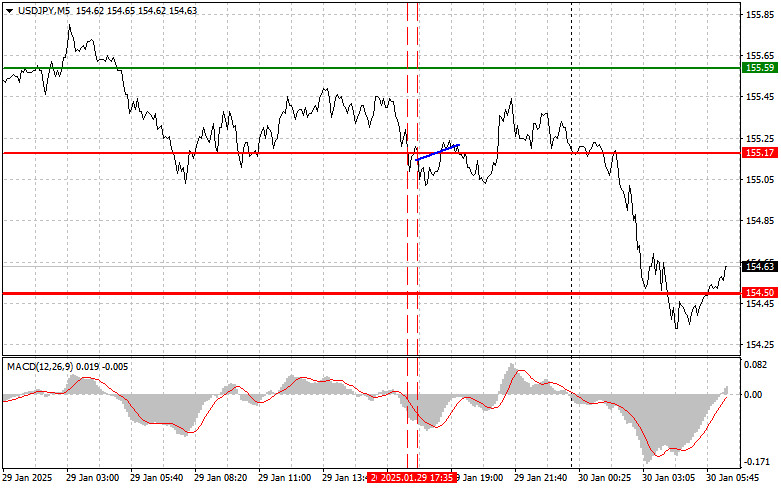

The test of the 155.17 level occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the potential for further declines in the pair. Shortly after, another test of 155.17, while the MACD was in the oversold area, allowed for the execution of Scenario #2, leading to a 30-pip increase in the pair.

Yesterday's Federal Reserve interest rate decision provided only temporary support for the U.S. dollar against the yen. Powell's statements indicated that strong economic growth, alongside a robust labor market, gives officials the ability to wait for more evidence of declining inflation before making any further adjustments to interest rates. This led to an increase in dollar purchases; however, it was not sufficient to counteract the ongoing positive impact of the Bank of Japan's policy, which aims to raise interest rates in the near future. Long positions in the yen have benefited from this factor. Despite a short-term rally in the U.S. dollar, long-term prospects remain uncertain. Market participants are closely observing the Fed's forthcoming actions and their broader economic implications in the U.S. The Fed's slower response to growth potential, in contrast to the BOJ 's more proactive stance, could leave the dollar at a disadvantage in the global currency market.

For my intraday strategy, I will primarily focus on implementing scenarios No. 1 and No. 2.

Buy Signal

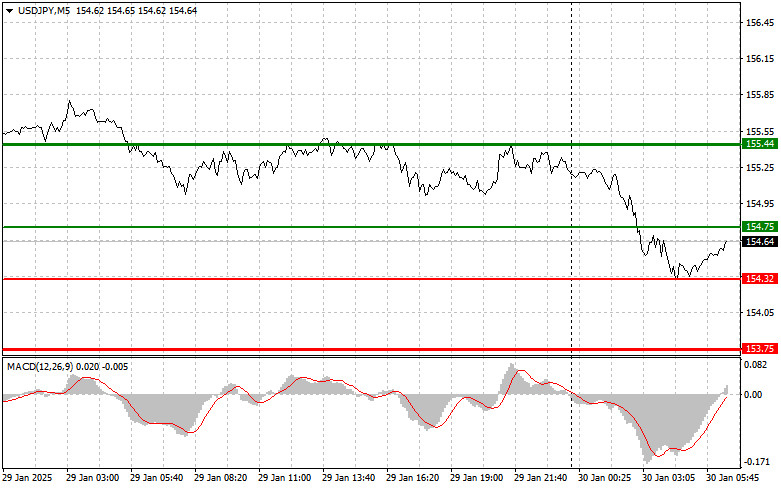

Scenario #1: I plan to buy USD/JPY today when I reach the entry point around 154.75 (green line on the chart) with the goal of rising to 155.44 (thicker green line). Around 155.44, I plan to exit purchases and open sales in the opposite direction (counting on a movement of 30-35 pips in the opposite direction from the level). It is best to return to buying the pair during corrections and serious drawdowns of USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price of 154.32 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. We can expect growth to the opposite levels of 154.75 and 155.44.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after updating the level of 154.32 (red line on the chart), which will lead to a rapid decline in the pair. The key target of sellers will be the level of 153.76, where I plan to exit sales and immediately open purchases in the opposite direction (counting on a movement of 20-25 pips in the opposite direction from the level). The pressure on the pair may return at any time. Important! Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell USD/JPY today if the price of 154.75 is tested twice consecutively at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse downward market reversal. A decline to the opposite levels of 154.32 and 153.75 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.