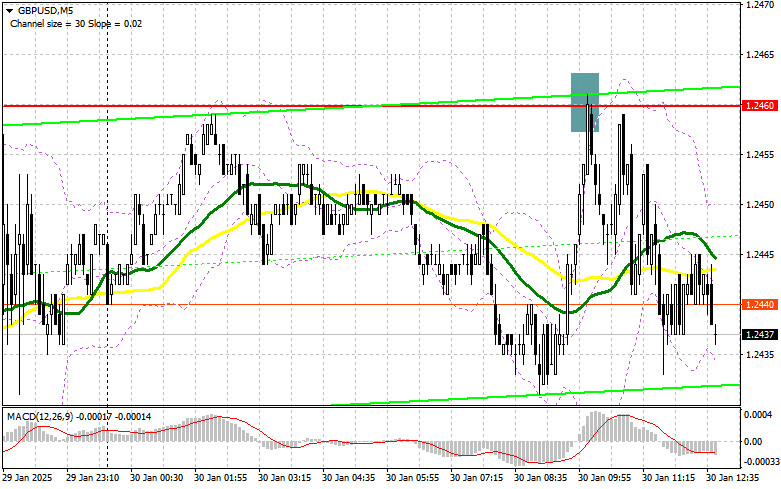

In my morning forecast, I emphasized 1.2460 as a key level for market entries. Looking at the 5-minute chart, the false breakout at 1.2460 provided an excellent selling opportunity, leading to a drop of over 30 points. The technical outlook for the second half of the day remains unchanged.

Buying Strategy for GBP/USD

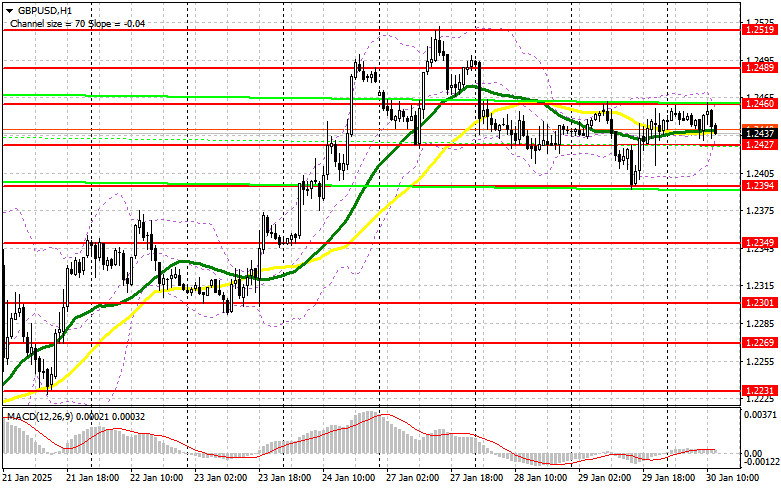

Despite decent lending data from the UK, the pound attempted to break above 1.2460 in the first half of the day but failed to gain support from major players, quickly returning to its sideways range. In the second half of the day, traders will shift focus to the U.S. Q4 GDP growth figures and Initial Jobless Claims

A significant slowdown in U.S. economic growth at the end of last year could be problematic for economists and the Federal Reserve, which kept rates unchanged yesterday. Such a scenario would pressure the dollar and potentially trigger stronger demand for the British pound. However, strong U.S. economic data could increase bearish pressure on GBP/USD.

If GBP/USD declines, I will consider buying only after a false breakout around the 1.2427 support level, expecting a new rise toward 1.2460. This level is expected to attract sellers again. A break and retest of 1.2460 from above would confirm bullish continuation, opening the door for a move to 1.2489, reinforcing the bullish trend. The final target will be 1.2519, where I will take profits.

If GBP/USD drops further and fails to find buyers at 1.2427, bearish momentum could accelerate. In this case, I will wait for a false breakout at 1.2394 before considering long positions. If the decline extends, I will consider buying at 1.2349 for a 30-35 point intraday correction.

Selling Strategy for GBP/USD

Sellers are attempting to regain control, but they need strong U.S. data to push the pair lower. If GBP/USD rises again, I will sell from the 1.2460 resistance level, following the same strategy as in the morning. A false breakout at 1.2460, combined with strong U.S. data, would create a selling opportunity, targeting 1.2427. A break and retest of 1.2427 from below would clear stop-loss orders and open the way to 1.2394. The final bearish target will be 1.2349, where I will take profits.

If GBP/USD rallies and sellers fail to defend 1.2460, the bullish trend could resume. In that case, I will wait for a test of 1.2489 before considering short positions. A false breakout at 1.2489 would provide a short entry. If the pair continues higher, I will look for sell opportunities at 1.2519, aiming for a 30-35 point downside correction.

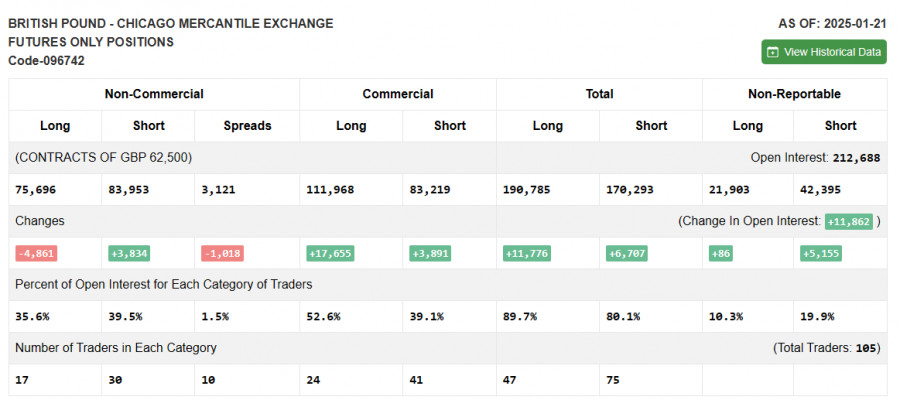

COT Report (Commitments of Traders – January 21)

The latest COT data shows that short positions increased, while long positions declined, shifting the market bias further in favor of sellers. UK economic data remains weak, while inflation has resumed its upward trend, putting the Bank of England in a tough spot. The BoE is likely to cut rates at its next meeting, a factor already reflected in GBP pricing. However, the pound's short-term movement depends on Trump's policies and the strength of the U.S. dollar.

Key COT data:

- Long non-commercial positions declined by 4,861, to 75,696.

- Short non-commercial positions increased by 3,834, to 83,953.

- The net short position expanded by 1,018.

Indicator Signals for GBP/USD

Moving Averages:

The pair is trading near the 30-day and 50-day moving averages, indicating market uncertainty.

Bollinger Bands:

If GBP/USD declines, the lower Bollinger Band around 1.2427 will act as support.

Indicator Descriptions

Moving Averages:

- 50-period Moving Average – Identifies the current trend by smoothing volatility and noise. (Displayed in yellow on the chart.)

- 30-period Moving Average – Provides additional confirmation of the trend direction. (Displayed in green on the chart.)

MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period.

- Slow EMA: 26-period.

- SMA: 9-period.

Bollinger Bands:

- Period: 20.

- Used to identify volatility levels and potential reversal points.

Commitments of Traders (COT) Report:

- Non-commercial traders – Speculative participants, including retail traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet specific criteria.

- Long non-commercial positions – Represent the total open long positions held by speculative traders.

- Short non-commercial positions – Represent the total open short positions held by speculative traders.

- Net non-commercial position – The difference between short and long positions among speculative traders.