Analysis of Trades and Trading Tips for the Euro

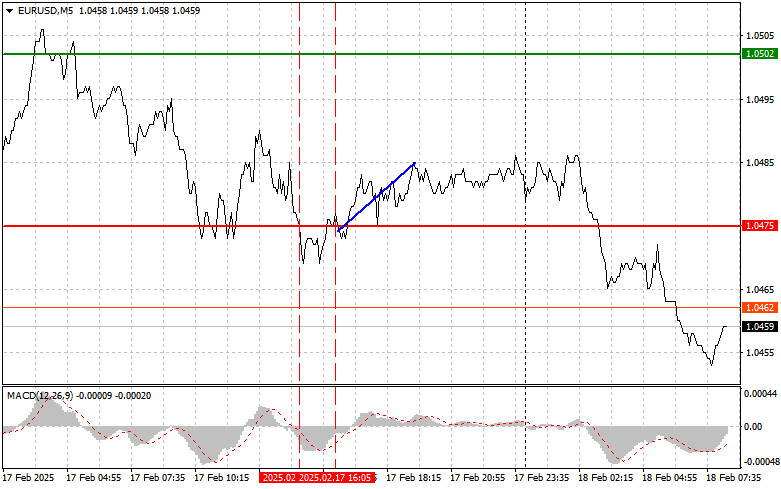

The price tested the level of 1.0475 when the MACD indicator had already moved significantly below the zero mark, limiting the euro's downside potential. For this reason, I chose not to sell the euro. The second test of 1.0475 occurred shortly after and coincided with the MACD recovering from the oversold area, allowing for a buying opportunity in Scenario No. 2. However, the pair only gained 10 pips.

Comments made yesterday by Federal Reserve officials regarding the need to delay rate cuts sparked renewed optimism among dollar buyers. This new information significantly impacted the forex market, and during today's Asian trading session, pressure on the EUR/USD pair intensified quickly. Investors, encouraged by the prospect of a stronger U.S. dollar, became more active, which inevitably influenced exchange rate movements.

Today, a series of economic reports from Germany will be released, and weak data could further worsen the position of euro buyers. Given the current economic situation in the region, analysts forecast a further decline in business sentiment among German entrepreneurs. Any negative surprises in the published data may trigger a sell-off in the euro, especially if combined with ECB rhetoric on inflation.

The EU finance ministers' meeting will provide further insight into the region's fiscal policy outlook. Investors will closely monitor statements from officials, assessing the governments' readiness to implement additional economic support measures in the face of high inflation and rising interest rates.

A crucial element will be how the market responds to any signs of disagreement among EU member states concerning the geopolitical situation and solutions for the energy crisis. Such disputes could undermine investor confidence in the euro, resulting in further weakening of the currency.

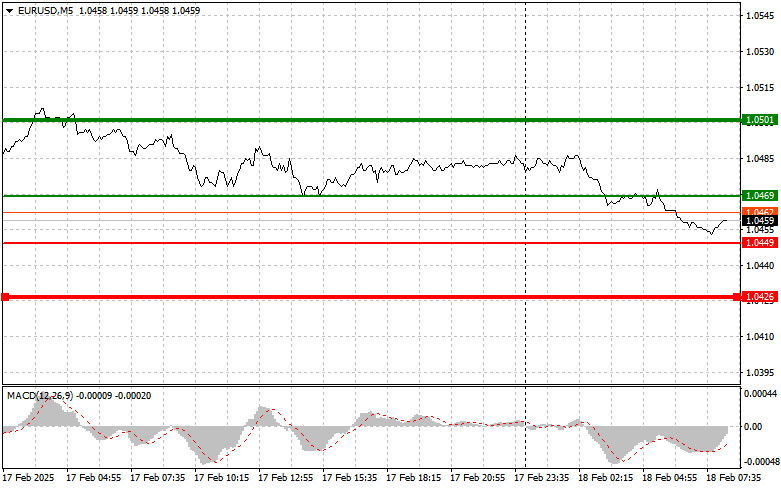

For intraday trading, I will mainly rely on Scenario No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible at 1.0469 (green line on the chart) with a target of 1.0501. I plan to exit the market at 1.0501 and immediately sell the euro, anticipating a 30-35 pip decline. Expecting euro growth in the first half of the day is reasonable only if Germany's economic data is strong. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario No. 2: I also plan to buy the euro if there are two consecutive tests of 1.0449 while the MACD indicator is in the oversold area. This setup will limit the pair's downside potential and trigger an upward market reversal. A rise to the opposite levels of 1.0469 and 1.0501 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the 1.0449 level (red line on the chart). The target is 1.0426, where I intend to exit the market and immediately buy in the opposite direction, expecting a 20-25 pip rebound. Selling pressure will return to the pair if today's economic data is very weak. Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline from it.

Scenario No. 2: I also plan to sell the euro if there are two consecutive tests of 1.0469 while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline to the opposite levels of 1.0449 and 1.0426 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.The thin red line represents the entry price where the trading instrument can be sold.The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.