Analysis of Trades and Trading Tips for the Euro

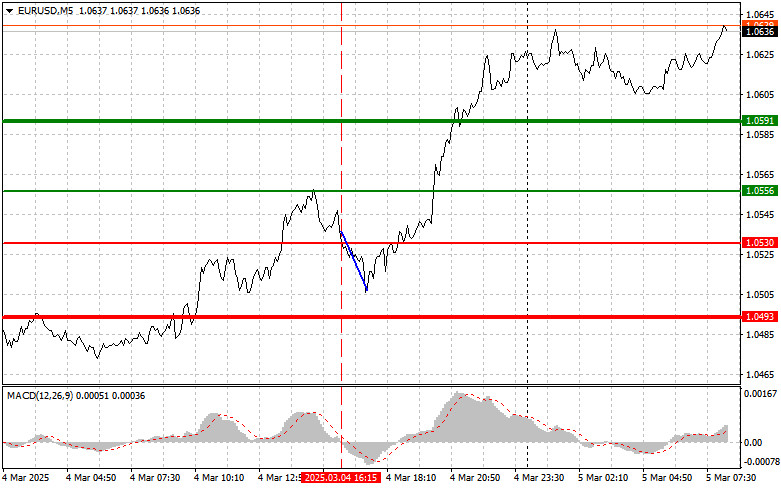

The price test at 1.0530 coincided with when the MACD indicator began moving downward from the zero mark. This confirmed the correct entry point for selling the euro, resulting in a 25-pip decline in the pair.

Yesterday's strong labor market data for the eurozone and Germany's decision to break free from fiscal constraints triggered euro purchases, pushing the pair to a new monthly high. This bold move by Berlin, demonstrating a willingness to take financial risks for geopolitical stability, caused a ripple effect across the currency market. Investors are reassessing the outlook for the European economy, anticipating increased government spending and economic stimulus. However, whether Germany and Europe can effectively allocate the released resources without jeopardizing financial stability in the long run remains an open question and will determine future market dynamics.

Today, the euro's rise will likely stall after the composite index and services PMI data for the eurozone. Disappointing results will limit the currency pair's growth potential. Data pointing to a slowdown in the services sector may heighten recession fears. Considering that the European Central Bank is set to continue cutting interest rates tomorrow, the chances of another strong euro surge are quite low, so be cautious when buying at highs.

The eurozone's producer price index should also be considered when making trading decisions. A decline in this indicator will negatively impact the euro's position. Investors are concerned about inflation, which could force the ECB to slow down stimulus measures, thereby supporting the euro.

For intraday strategy, I will focus more on executing Scenarios #1 and #2.

Buy Signal

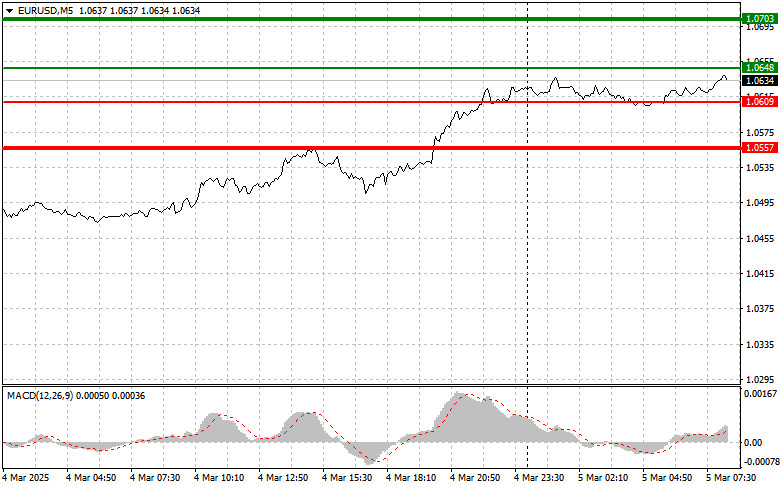

Scenario #1: Today, I plan to buy the euro if the price reaches around 1.0648 (green line on the chart), with a target of rising to 1.0703. At 1.0703, I will exit the market and sell the euro in the opposite direction, expecting a 30-35 pip pullback. A euro rise in the first half of the day will likely only be possible if eurozone data are very strong. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0609 price level while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal to the upside. A rise toward the opposite levels of 1.0648 and 1.0703 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0609 level (red line on the chart). The target will be 1.0557, where I will exit the market and immediately buy in the opposite direction, expecting a 20-25 pip pullback. Selling pressure on the pair will return if today's economic data is very weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0648 price level while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline toward the opposite levels of 1.0609 and 1.0557 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.