The GBP/USD currency pair continued to rise on Wednesday, and at this point, speeches by central bank representatives or macroeconomic data are not necessary for this movement. The only thing that matters is Donald Trump, who speaks every day, gives interviews left and right, and threatens half the world's countries. The dollar is plunging into an abyss even though, in the short term, Trump's policies might benefit the U.S. However, we have repeatedly warned that major global players will not dance to Trump's tune. The U.S. president wants to balance the trade deficit. But who is to blame for that deficit? If American consumers prefer Chinese goods because they are cheaper or European cars because of their quality, is that China's and the EU's fault? Or is it America's fault, where labor, goods, and services are astronomically expensive?

The market now fully understands that trade wars will last for at least the next four years. How much will trade between the U.S. and other countries decline over that period? How much will the trade balance shrink, and what losses will American companies suffer? What would the impact be if they had previously produced 100 units of a product but now only 80 units due to decreased demand? American goods were already expensive, and now they will be even more costly in all the countries with which Trump has picked a fight. His calls to hand over Greenland, reclaim the Panama Canal, or annex Canada to the U.S. are now met with laughter. Why doesn't Trump take it further and rename London to "New Trump" or express a desire to annex Russia?

Each new statement from Trump makes the world open its eyes even wider. We were surprised by his foreign policy style 4-8 years ago, but it turns out that he was still quite diplomatic back then. At this rate, in four years, Americans might vote for literally anyone to get Trump out of office. The U.S. House of Representatives is already preparing the first impeachment procedure against the president. "First" because it is unlikely to be the last. During Trump's first term, Congress and the Senate voted twice on impeachment. Both attempts failed. Will the third attempt succeed? Or the fourth? Or will mass protests erupt across the country?

At this point, there is no reason even to attempt to find macroeconomic justifications for the GBP/USD pair's growth. There aren't any. Even yesterday, business activity indices in the services sectors of Germany, the EU, and the UK showed figures that should have encouraged the market to sell the euro and the pound. But the euro and the pound continued rising calmly—just as they did on Monday and Tuesday. We will not speculate on where or when the dollar's collapse will end. If Trump continues on this path, the U.S. currency could keep falling, regardless of the Federal Reserve's monetary policy or other factors.

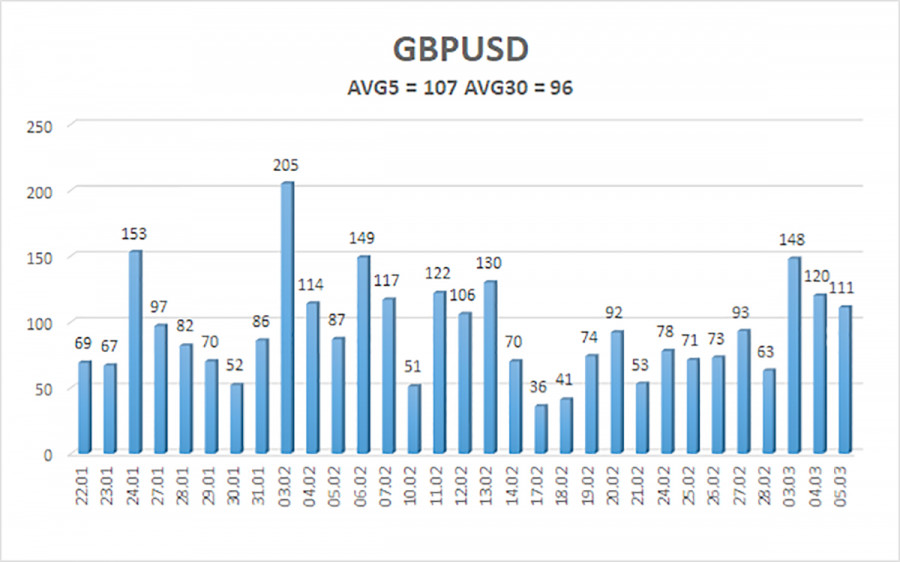

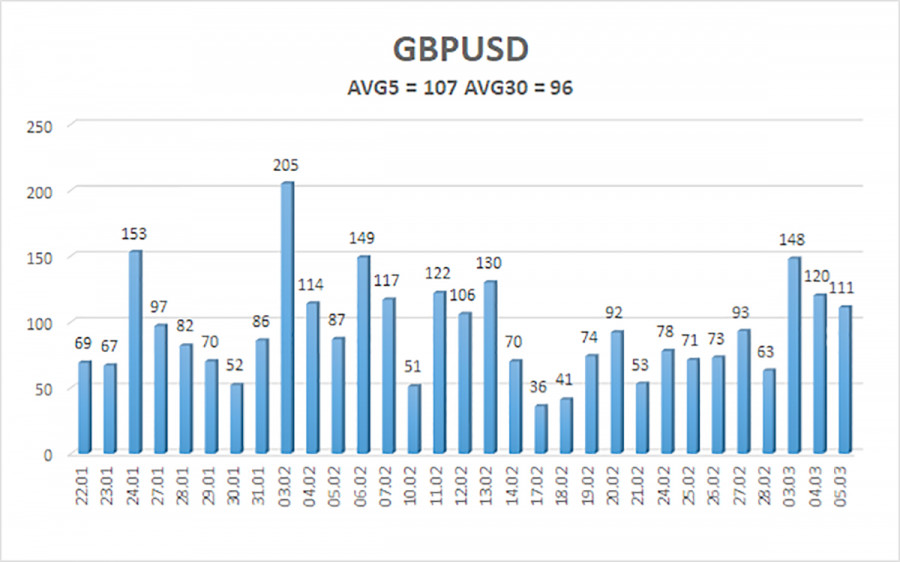

The average volatility of the GBP/USD pair over the last five trading days is 107 pips, which is considered "moderate" for this currency pair. Therefore, on Thursday, March 6, we expect movement within the range of 1.2753 to 1.2967. The long-term regression channel has turned sideways, but the overall downward trend remains visible on the daily timeframe. The CCI indicator entered the overbought zone, signaling a possible decline, but the drop was very weak.

Nearest Support Levels:

S1 – 1.2817

S2 – 1.2695

S3 – 1.2573

Nearest Resistance Levels:

R1 – 1.2939

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downward trend. We still do not consider long positions, as we believe the current upward movement is a correction that has turned into an illogical, panic-driven rally. If you trade purely on technical analysis, long positions are possible, with targets at 1.2939 and 1.2967 if the price remains above the moving average. However, sell orders remain much more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will inevitably end sooner or later. A confirmation in the form of consolidation below the moving average is required. The British pound looks extremely overbought, but Donald Trump continues to push the dollar into the abyss.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.