Analysis of Trades and Trading Tips for the British Pound

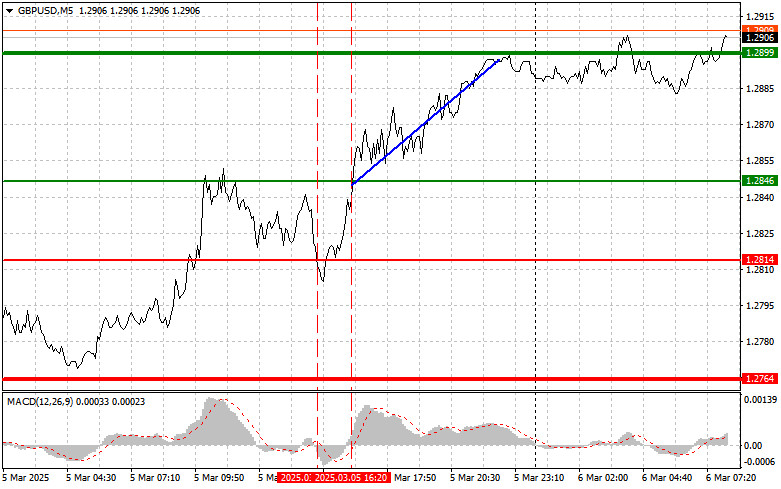

The test of the 1.2814 price level occurred when the MACD indicator was beginning to move downward from the zero mark, confirming the correct entry point for selling the pound. However, as seen on the chart, the decline never materialized. Instead, another price increase led to a test of the 1.2846 level during the middle of the US session. This test coincided with the start of the MACD indicator moving up from the zero mark, which allowed for a buying opportunity, resulting in a gain of about 50 pips, covering the losses from selling and even securing some profit.

Considering that even weak UK services sector data did not trigger a proper correction for the pound, this indicates the strength of the bullish trend. In the short term, the pound appears overbought, but a strong reason for a meaningful correction has yet to emerge. Investors should closely monitor macroeconomic indicators and signals from the central bank. A breakout of key support levels may confirm the start of a deeper correction, while stability above these levels would indicate the continuation of the upward trend.

Today, the UK Construction PMI data is set to be released, but even weak figures are unlikely to prompt traders to sell the pound. Contrary to expectations, the British currency remains remarkably resilient, reflecting broader confidence in the economy rather than just in a single sector. Geopolitical factors could trigger a sharp correction in the pound, but for now, the upward trend remains intact, with no signs of reversal.

For intraday strategy, I will focus more on executing Scenarios #1 and #2.

Buy Signal

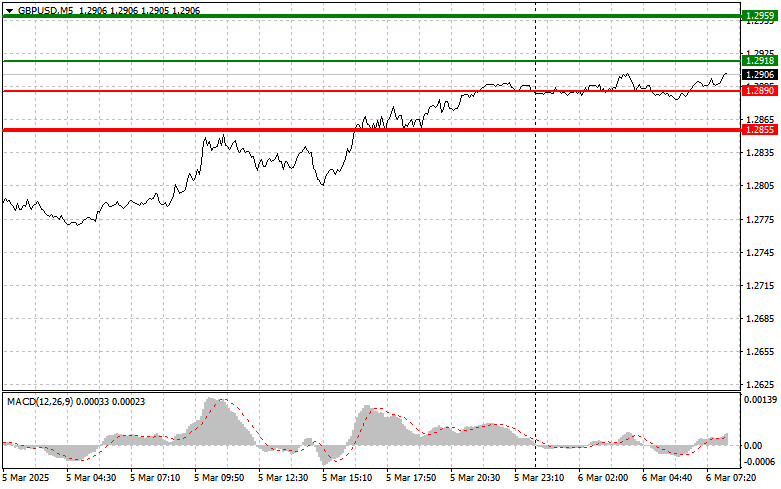

Scenario #1: I plan to buy the pound today if it reaches the entry point around 1.2918 (green line on the chart) with a target of rising to 1.2959 (thicker green line on the chart). At the 1.2959 level, I intend to exit the buy position and open a sell trade in the opposite direction, expecting a movement of 30-35 pips downward. The pound is expected to continue rising within the ongoing uptrend. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: Another buying opportunity arises if the price tests the 1.2890 level twice in succession while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to a market reversal upwards. A rise to the opposite levels of 1.2918 and 1.2959 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below the 1.2890 level (red line on the chart), which should trigger a quick decline in the pair. The key target for sellers will be the 1.2855 level, where I intend to exit the sell position and immediately open a buy trade in the opposite direction, expecting a movement of 20-25 pips upwards. Selling the pound is preferable at the highest possible level. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: Another selling opportunity arises if the price tests the 1.2918 level twice in succession while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.2890 and 1.2855 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.