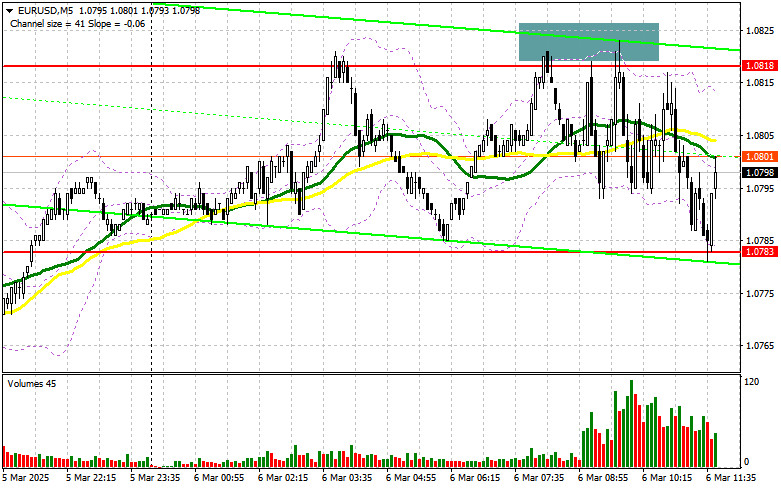

In my morning forecast, I focused on the 1.0818 level as a key point for making trading decisions. A look at the 5-minute chart reveals that a false breakout at this level provided a solid short entry, leading to a 35-point decline. The technical outlook for the second half of the day has been adjusted accordingly.

Long Position Strategy for EUR/USD:

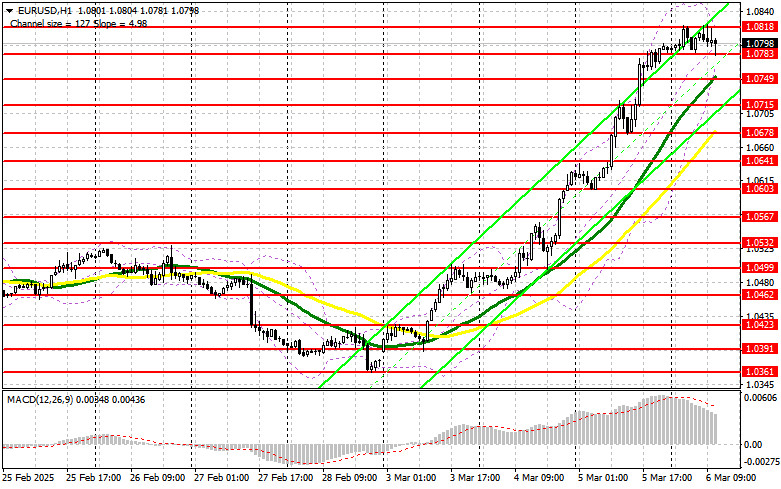

The lack of strong buying interest in the euro ahead of the European Central Bank's (ECB) rate decision has temporarily halted the bullish trend observed over the past three days. In addition to the ECB's decision, attention should be given to U.S. data releases, including initial jobless claims, non-farm labor productivity changes, and unit labor cost figures. If the data aligns with economists' forecasts, it may not provide significant support for the U.S. dollar. Furthermore, dovish remarks from FOMC member Christopher Waller could increase demand for the euro and put additional pressure on the dollar.

If the reaction to the data is bearish for the euro, protecting the nearest support at 1.0783 will be a priority for buyers. I plan to enter long positions only if a false breakout forms at this level, aiming for a continued rise toward the 1.0818 resistance, which was tested once during the European session. A breakout and subsequent retest of this range from above will confirm a buy entry, potentially pushing the pair to 1.0855. The final upward target will be the 1.0885 high, where I intend to take profits.

If EUR/USD declines and shows no significant activity around 1.0783, especially if the ECB adopts an unexpectedly dovish stance, demand for the euro could weaken, leading to a consolidation phase. In this scenario, sellers may push the pair toward 1.0749. I plan to enter long positions only after a false breakout at this level. Alternatively, I will consider buying on a direct rebound from 1.0715, targeting a 30-35 point intraday correction.

Short Position Strategy for EUR/USD:

Sellers asserted themselves in the first half of the day, preventing the pair from extending its monthly high into a sustained bullish trend. However, further price action depends on upcoming U.S. data, so heavy reliance on bearish momentum may not be advisable.

A false breakout around 1.0818—similar to what was observed earlier—will provide a valid short entry, targeting a correction toward support at 1.0783, where the pair is currently trading. A breakout and sustained move below this range—possible only if U.S. labor market data is significantly stronger than expected—would create another short-selling opportunity, with a downward target at 1.0749. The final target for short positions would be 1.0715, where I plan to take profits. This level also aligns with moving averages, which currently favor buyers.

If EUR/USD continues to rise in the second half of the day and sellers fail to defend the 1.0818 level, buyers could gain further momentum, leading to another strong rally. In this case, I will postpone short positions until a test of the next resistance at 1.0855. I will consider selling only if a failed consolidation occurs at this level. If the pair continues higher without a pullback, I will look for short entries at 1.0885, aiming for a 30-35 point downward correction.

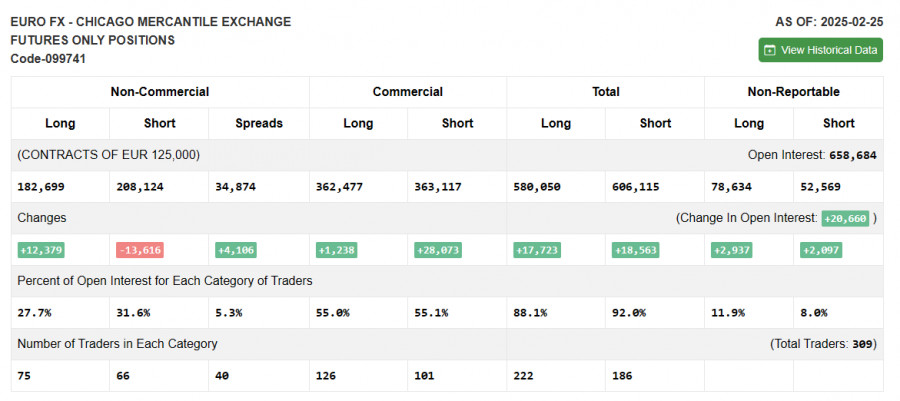

Commitments of Traders (COT) Report:

The COT report for February 25 showed an increase in long positions and a notable reduction in short positions. More traders are showing interest in buying the euro. The ongoing pressure from the U.S. on Ukraine to negotiate a ceasefire is increasing demand for risk assets. Additionally, Eurozone inflation data meeting the ECB's expectations supports further rate cuts, which could eventually benefit economic growth and make the euro more attractive for long-term buyers. However, sellers still hold an advantage, so caution is advised when buying at current highs.

The COT report indicates that long non-commercial positions increased by 12,379, reaching 182,699, while short non-commercial positions declined by 13,616, bringing the total to 208,124. As a result, the gap between long and short positions narrowed by 4,106.

Indicator Signals:

Moving AveragesThe pair is trading above the 30 and 50-period moving averages, indicating continued bullish momentum.

Note: The author's analysis is based on the hourly (H1) chart, which differs from traditional daily (D1) moving average calculations.

Bollinger BandsIf the pair declines, the lower boundary of the Bollinger Bands at around 1.0780 will act as support.

Indicator Descriptions:

- Moving Averages (MA): Used to identify the current trend by smoothing out price volatility and noise.

- MACD (Moving Average Convergence/Divergence): A momentum indicator that helps assess trend direction and potential reversals.

- Bollinger Bands: A volatility-based indicator that helps identify overbought and oversold conditions.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, who use futures markets for speculative purposes.

- Long non-commercial positions: The total number of long positions held by speculators.

- Short non-commercial positions: The total number of short positions held by speculators.

- Net non-commercial position: The difference between the number of long and short positions held by speculators.