The GBP/USD currency pair experienced a decline of about 100 pips at the beginning of the day and week on Monday, followed by an additional drop of 40 pips. However, as the day progressed, the pound sterling began to recover and by the evening, it had completely closed the gap. Ideally, traders would like to see strong economic data from the UK and weak reports from the US. In such a scenario, the pair's growth would seem logical and justified. Conversely, if the opposite occurs, traders may be left confused by each price movement.

It's important to note that, in addition to numerous significant macroeconomic releases, the Bank of England is scheduled to hold its meeting this week. Given the importance of this event, a market reaction is inevitable. Unfortunately, we are facing a challenging situation: a broken technical picture right before a series of crucial events and reports. Moreover, Donald Trump's decisions regarding tariffs are unlikely to end anytime soon, meaning the currency market—and other markets—may experience further turmoil in the near future.

Trump continues to send aggressive signals. He is demanding that Panama hand over control of the Panama Canal to the US; that the European Union purchase more cars, raw materials, and agricultural products from America—or face sanctions and tariffs; that Denmark transfer control of Greenland to the US; and that Canada simply become the 51st state of the US. From our perspective, the world is on the brink of new global upheavals, and the cause seems clear: Donald Trump. It is doubtful that countries around the world will simply comply with his demands as if he were the president of the entire world. Therefore, we would advise preparing for a storm. This turmoil will not only impact the dollar or euro but will affect the entire currency market, the stock market, and regions beyond the US and Mexico.

When looking at the economy and macroeconomic data, the UK released only one noteworthy report on Monday. The Manufacturing PMI for January increased from 47.0 to 48.3, which is 0.1 points higher than forecasts. However, following the significant news over the weekend, this report did not capture much attention.

Similar to the euro, we believe that the GBP/USD pair needs to rebalance. This process could take another day. However, the current technical picture leaves us uncertain about what to expect next. The pound sterling is currently below the moving average, but if the market continues to find its balance, it may soon rise back above it. The upward correction on the daily timeframe appears incomplete, suggesting that a new wave of correction targeting levels above 1.2500 could begin. It would be beneficial if upcoming reports and events support the pound in the near future, as this would likely lead to a predictable rise. Conversely, if they do not, we may see a confusing mix of factors, each subject to different interpretations by market participants. In such a scenario, prices may fluctuate wildly, making it extremely challenging to understand these movements.

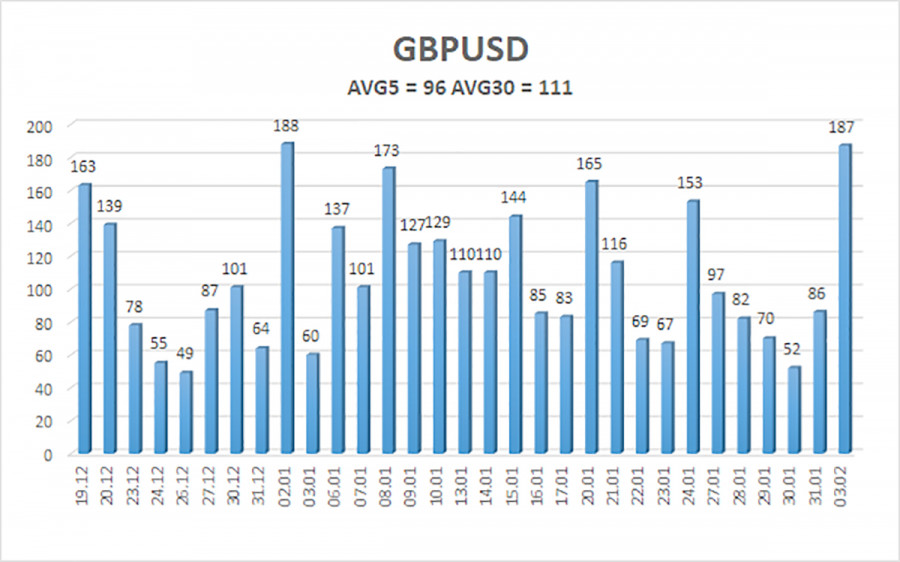

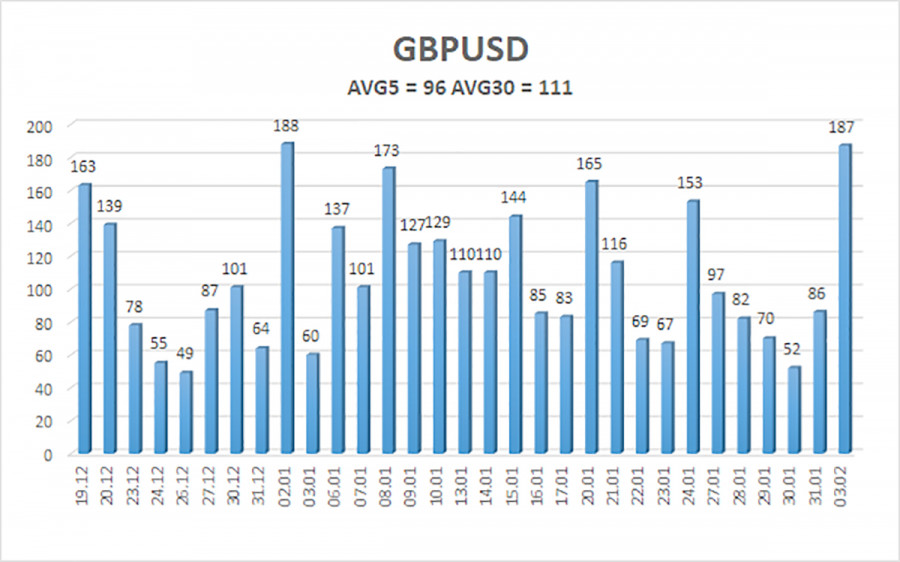

The average volatility of the GBP/USD pair over the last five trading days is 96 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, February 4, we expect the pair to move within a range bounded by 1.2307 and 1.2499. The higher linear regression channel is directed downward, signaling a bearish trend. The CCI indicator has entered the oversold area, so a new upward correction is now expected.

Nearest Support Levels:

- S1 – 1.2390

- S2 – 1.2329

- S3 – 1.2268

Nearest Resistance Levels:

- R1 – 1.2451

- R2 – 1.2512

- R3 – 1.2573

Trading Recommendations:

The GBP/USD currency pair is currently experiencing a downward trend in the medium term. We are not considering long positions, as we believe that all factors supporting the rise of the British currency have already been priced in by the market, and no new factors have emerged.

If you are trading based solely on technical analysis, long positions may be viable with targets set at 1.2499 and 1.2573, provided the price stays above the moving average line. Conversely, sell orders remain more relevant, with initial targets of 1.2307 and 1.2268, but the price must remain below the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.