Analysis of Trades and Trading Tips for the British Pound

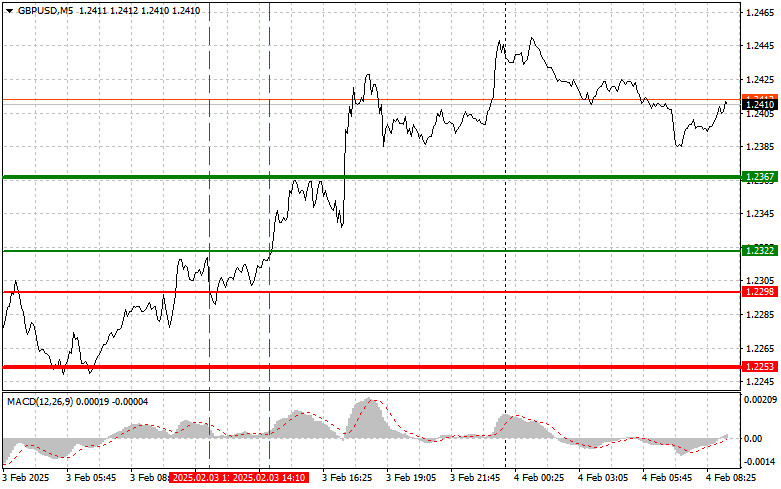

The test of the 1.2322 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pound's further upward potential. Therefore, I decided not to buy. Additionally, the test of the 1.2298 level took place when the MACD was well below zero, restricting the potential for new short positions.

Asian markets are showing moderate activity today as investors closely monitor the impact of new tariffs. In response to American measures, China has announced its own trade restrictions, leading to uncertainty in the markets. However, the pressure on the pound has not significantly increased, indicating its relative stability amidst heightened volatility.

For the pound, not only are US-China relations important, but domestic economic indicators from the UK and the upcoming Bank of England meeting on monetary policy are also crucial. Expectations of interest rate cuts by the Bank of England could put pressure on the currency, as analysts and investors have serious concerns about the UK's economic situation. Rising inflation, driven by increased energy and food prices, is affecting households and reducing consumer purchasing power. At the same time, the economic contraction observed in recent quarters indicates declining demand and falling manufacturing activity, which raises doubts about the sustainability of recovery. For these reasons, a significant rise in the pound in the near future is unlikely.

Regarding the intraday strategy, I will rely more on the implementation of Scenarios #1 and #2.

Buy Signal

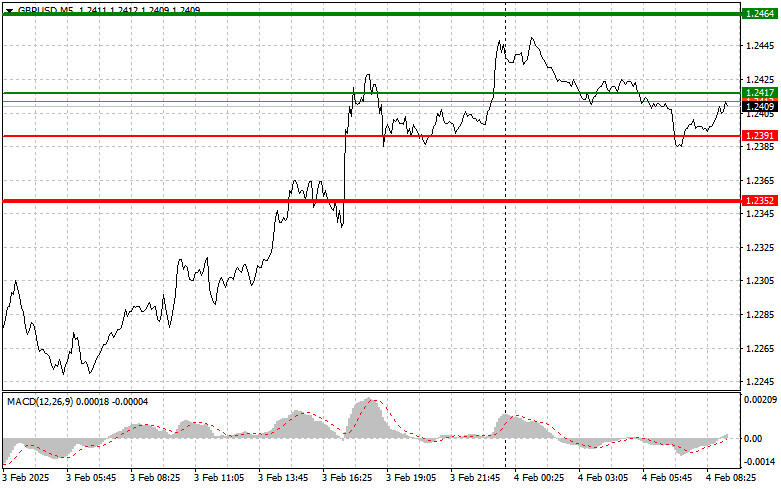

Scenario #1: I plan to buy the pound today if the entry point reaches around 1.2417 (green line on the chart) with a target of rising to 1.2464 (thicker green line on the chart). Around 1.2464, I plan to exit long positions and open short positions in the opposite direction (expecting a 30-35 pip movement from the entry point). A substantial rise in the pound in the near future is unlikely. Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2391 price level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. Growth towards the opposite levels of 1.2417 and 1.2464 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below the 1.2391 level (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.2352 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20-25 pip movement back from the level). It's better to sell the pound as high as possible. Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2417 price level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline towards the opposite levels of 1.2391 and 1.2352 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.