Analysis of Trades and Trading Tips for the Japanese Yen

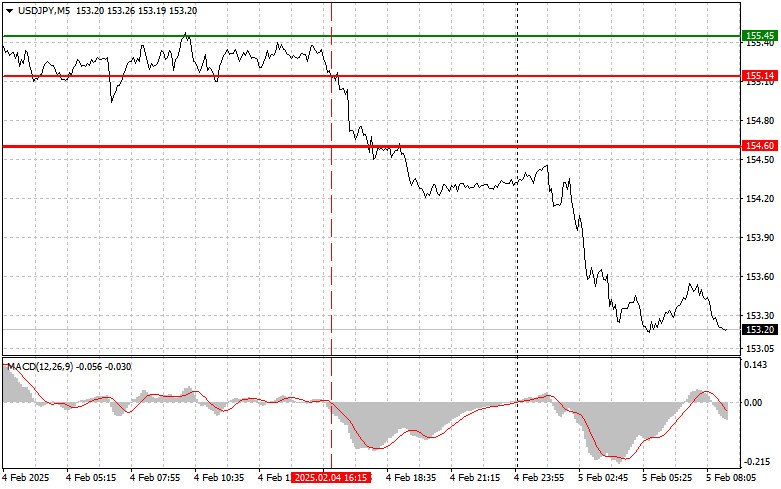

The price test at 155.14 aligned with the MACD indicator, which had just begun to move down from the zero mark. This confirmed a suitable entry point for selling the dollar, resulting in a drop of over 50 pips in the currency pair.

Yesterday's weak U.S. economic data once again highlighted the potential harm of Trump's trade war, not only to the targeted countries but also to the United States itself. This situation weakened the dollar's position, especially against the Japanese yen. Protective measures imposed by other countries on imports could lead to higher consumer prices, which would reduce purchasing power and slow economic growth. Such developments could negatively impact U.S. export performance, while Japan and other countries might benefit from increased demand for their goods.

Consequently, the uncertainty created by trade tensions continues to exert pressure on the U.S. economy and its currency.

Today's Japanese wage data, which significantly exceeded economists' forecasts, triggered a fresh sell-off in USD/JPY. This market reaction underscores a lack of investor concern over how rising wages might affect the country's economic policy. Expectations that higher incomes could lead to inflationary pressure prompted traders to reassess their positions on the yen. The reported 4.8% annual wage growth in Japan signaled to investors the potential for further monetary tightening by the Bank of Japan. This development, in turn, boosts demand for the yen, making it more attractive to buy.

I will primarily rely on the execution of Scenarios #1 and #2 for today's trading plan.

Buy Signal

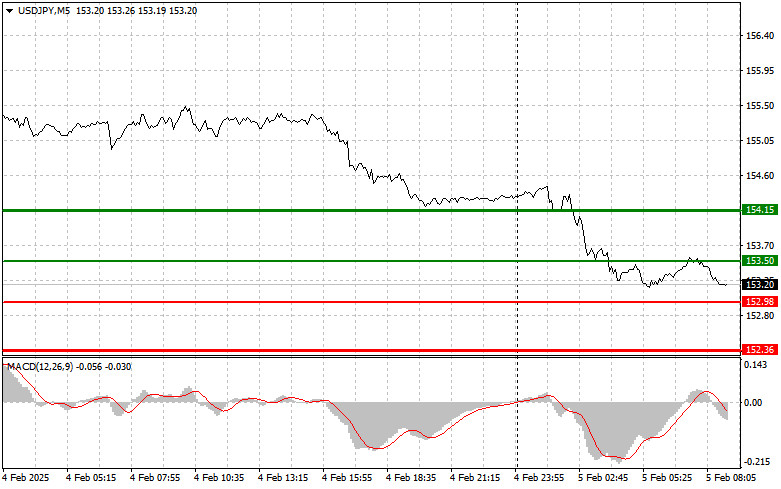

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point at 153.50 (green line on the chart), targeting a rise to 154.15 (thicker green line on the chart). At 154.15, I plan to exit long positions and initiate short trades for a 30-35 pip pullback from the entry point. It's best to return to buying the pair during corrections and significant dips in USD/JPY. Important: Before buying, ensure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 152.98 level while the MACD is in oversold territory. This will limit the pair's downward potential and lead to a market reversal to the upside. Expected targets are 153.50 and 154.15.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after the price breaks below 152.98 (red line on the chart), leading to a quick decline in the pair. The key target for sellers will be 152.36, where I plan to exit short positions and immediately open long positions for a 20-25 pip rebound from the entry point. Selling pressure on the pair is expected to persist today. Important: Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 153.50 level while the MACD is in overbought territory. This will limit the pair's upward potential and lead to a market reversal to the downside. Expected targets are 152.98 and 152.36.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.