The EUR/USD currency pair continued its rapid ascent on Friday. At the beginning of the week, we were cautious about further euro appreciation, but by the end of the week, it became clear that this movement was not only possible but had already materialized. Over the week, the euro gained 200 pips despite a lack of objective fundamental reasons. Last week was filled with fundamental and macroeconomic events. Some supported the dollar, while others favored the euro. Now, let's break down what exactly supported each currency.

To start, let's list the reports and events that worked in favor of the euro: the second estimate of Eurozone GDP for Q4 and the U.S. retail sales report. That's it. This is the entire list. The European GDP report was published on Friday, meaning that the euro had already covered 90% of its upward movement by the time it came out. GDP can hardly be considered a strong positive factor, as economic growth reached only +0.1% against a forecast of 0%, making the deviation minimal and the overall growth insignificant. Meanwhile, U.S. retail sales fell by 0.9% versus the expected -0.1%, and this report was also released on Friday.

Now, let's list all the events that supported the U.S. dollar: two speeches by Jerome Powell in Congress, where the Federal Reserve Chair reaffirmed that the central bank is in no rush to cut interest rates; the U.S. inflation report, which showed inflation accelerating for the fourth consecutive month, reinforcing Powell's statements and lowering the likelihood of even two rate cuts in 2025; the actual inflation rate, now at 3%—1.5 times higher than the Fed's 2% target; Germany's inflation, which fell to 2.3%, slightly increasing the probability of further ECB rate cuts; Eurozone industrial production, which declined by 1.1% in December, worse than the forecast of -0.6%; and U.S. industrial production, which grew by 0.5%, exceeding expectations of +0.3%.

It is evident that most of the events favored the dollar over the euro. The reason for the euro's rise is straightforward, and we had anticipated it even before this rally began. The daily timeframe remains in a corrective phase that has not yet concluded. This correction has been relatively weak compared to the euro's three-month decline. This technical factor is the primary reason behind the euro's rise. Before initiating another global downtrend, market makers need to accumulate new short positions, and for that to happen, prices must rise to create more favorable selling conditions.

Corrections typically take time, and the euro could continue to rise for another month or two, although the increases are likely to be modest and accompanied by frequent downward pullbacks. The only unexpected aspect last week was the intensity of the rally, which exceeded expectations.

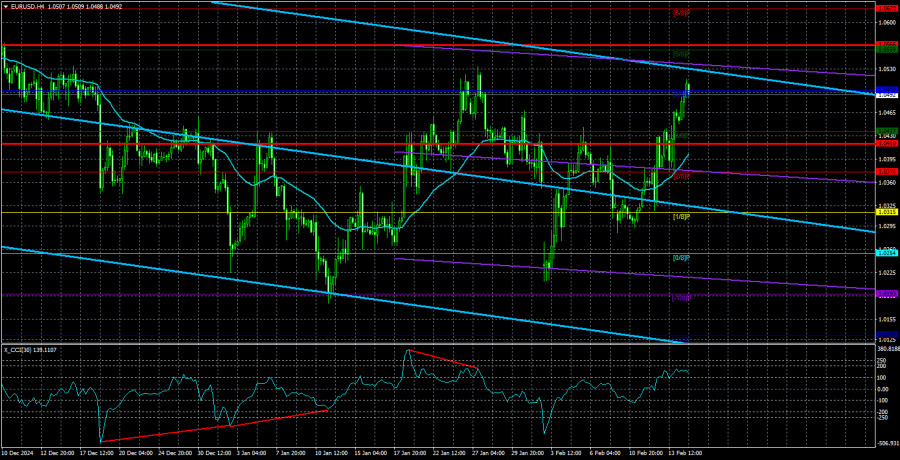

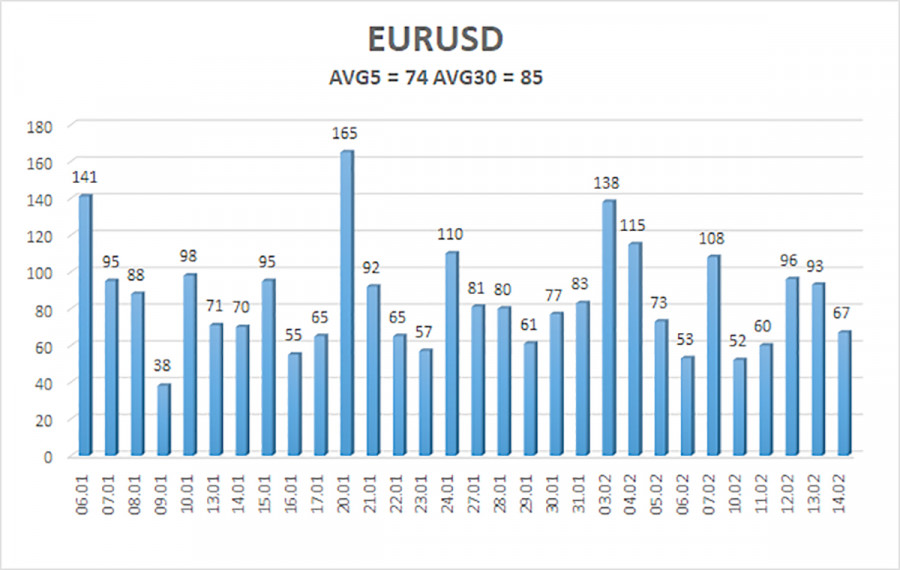

The average volatility of the EUR/USD pair over the last five trading days as of February 17 is 74 pips, classified as "moderate." We expect the pair to trade between 1.0418 and 1.0566 on Monday. The long-term regression channel remains downward, signaling that the global bearish trend persists. The CCI indicator recently entered oversold territory and is now rising again.

Nearest Support Levels:

S1 – 1.0437

S2 – 1.0376

S3 – 1.0315

Nearest Resistance Levels:

R1 – 1.0498

R2 – 1.0559

R3 – 1.0620

Trading Recommendations:

The EUR/USD pair continues its corrective upward movement. For the past few months, we have consistently stated that we expect the euro to decline in the medium term, and this outlook remains unchanged. The Fed has paused its monetary easing cycle, while the European Central Bank is accelerating its rate-cutting plans. The dollar has no fundamental reasons to weaken in the medium term except for technical corrections. Short positions remain more attractive, but the technical correction could persist for some time.

For traders using pure technical analysis, long positions can be considered above the moving average, targeting 1.0559 and 1.0566. However, any rally should still be viewed as a correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.