The GBP/USD currency pair traded relatively calmly on Monday, as expected. Over the past month, the British pound has experienced more periods of growth and fewer declines compared to the euro. This trend can be easily explained, as previously discussed. While the Bank of England plans to ease monetary policy twice as aggressively as the Federal Reserve, it still lags significantly behind the European Central Bank in this aspect. The ECB is on track to lower its key interest rate to 2% by summer and may cut it further by the end of the year, potentially even below the "neutral level." The Bank of England has outlined four rate cuts for this year, while the Fed has planned no more than two. This is why the pound remains more stable against the dollar than the euro.

However, in absolute terms, the British pound has not significantly outperformed the euro in recent weeks. It is important to note that market participants and investors tend to allocate capital to economies that are growing or have strong growth potential—something that cannot be said for the UK or European economies. As a result, both the euro and the pound are under market pressure and are not favored by traders.

Of course, this situation will change eventually—nothing lasts forever. A 16-year downtrend is already quite an extended period. However, for this trend to reverse, strong fundamental reasons are required. We still believe the British pound will reach the 1.18 level in 2025. Just look at the economic data coming from the UK: GDP growth is barely positive, and business activity indices, retail sales, and industrial production are weak. The Bank of England will ease monetary policy at least twice as aggressively as the Fed. This is done without even mentioning the factor of "preemptive market pricing."

The U.S. dollar experienced a decline between fall 2022 and fall 2024. During this time, inflation in the U.S. began to slow and continued to decelerate. The market appeared to be anticipating the Fed's future easing measures through preemptive dollar selling. While expectations for these easing measures were quite dovish, it's likely that the actual rate cuts will conclude at around 4.5%. Currently, U.S. inflation is rising, and Donald Trump's foreign policy could potentially accelerate this trend. Given that the U.S. economy is in solid shape, the Fed can sustain its current interest rates for as long as necessary. Moreover, the full impact of the Fed's easing cycle has already been factored into the market pricing, whereas the Bank of England's easing cycle has not yet been reflected. This leads us to believe that the British pound will likely trend downward. However, this doesn't imply that the pound will decline continuously every day, week, or month. In fact, it has already been correcting for a month and could continue this correction for another two months.

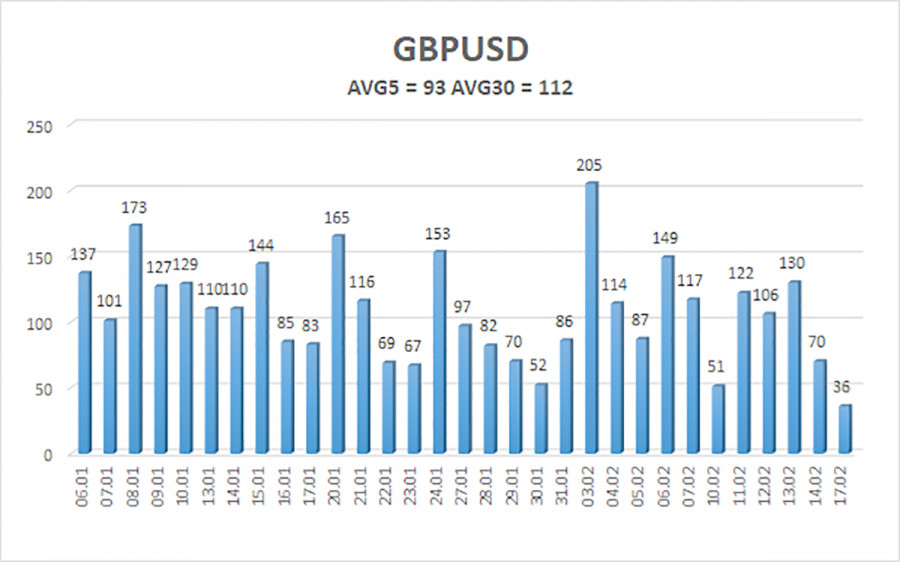

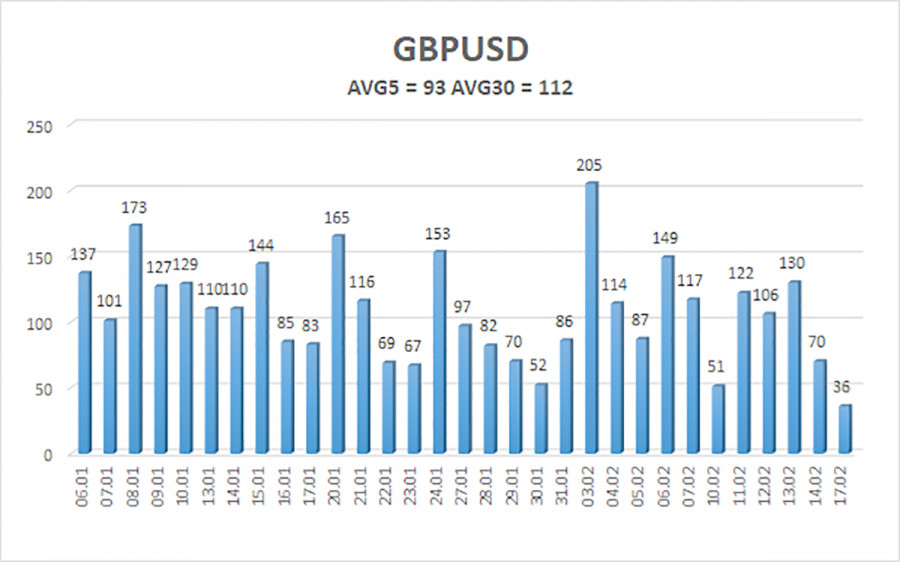

The average volatility of the GBP/USD pair over the last five trading days is 93 pips, which is considered "average." On Tuesday, February 18, we expect movement within the range of 1.2516 to 1.2702. The long-term regression channel remains downward, indicating a continued bearish trend. The CCI indicator entered the oversold zone, signaling a new upward correction phase.

Nearest Support Levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest Resistance Levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term bearish trend. We still do not consider long positions, as we believe that all bullish factors for the British currency have already been priced multiple times, and no new catalysts exist. If you trade based on pure technical analysis, long positions are possible with targets at 1.2634 and 1.2695 if the price remains above the moving average. However, short positions remain far more relevant, with targets at 1.2207 and 1.2146, as the ongoing upward correction on the daily time frame will eventually end. For short positions, the price must consolidate below the moving average. Ideally, shorts should be initiated at the peak of the current upward correction on the daily time frame, although this correction may last longer.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.