The EUR/USD currency pair continued its downward movement on Friday after failing once again to break above the 1.0525 level, which acts as the upper boundary of the sideways channel on the daily timeframe. In simple terms, the euro could not consolidate above this range, leading to a predictable new wave of decline. Even without considering the macroeconomic and fundamental backdrop favoring the dollar, we would have anticipated this decline—and that's exactly what occurred.

Over the past month and a half, the euro has shown notable weakness and an inability to counter the U.S. dollar effectively. What could potentially support the euro? The European Central Bank is set to cut all three key interest rates by another 0.25% this week, while uncertainty lingers over when the Federal Reserve will lower its rates again. It's entirely possible that there will be no monetary policy easing in the U.S. throughout 2025. U.S. inflation is rising, the economy is growing, the labor market is stable, and Donald Trump is taking measures that could push inflation even higher. Consequently, the Fed has no choice but to maintain interest rates at their current levels.

We have long anticipated the continued strength of the dollar because the market had prematurely priced in an overly dovish policy shift from the Fed. The U.S. economy is significantly stronger than that of the European Union. Moreover, the EU is currently on the brink of facing a "tariff grave."

We have noted that tariffs will also hurt the American economy, but to a lesser extent than the European economy, since Europe exports far more goods to the U.S. than the U.S. does to Europe. Furthermore, Europe will have to shoulder the financial burden of supporting Ukraine, as Washington has effectively abandoned further assistance to Kyiv. The U.S. is across the ocean, while Europe is right next door. Therefore, Brussels cannot simply tell Kyiv it is no longer a problem—it must allocate funds from its budget.

The immediate target remains 1.0220, the lower boundary of the sideways channel on the daily timeframe. In addition to the ECB meeting this week, the U.S. will release crucial macroeconomic reports, including ISM indices, Non-Farm Payrolls, and the unemployment rate. If these reports disappoint, the dollar may weaken, but any decline will still occur within the daily timeframe's sideways range. The broader fundamental background will continue to push the dollar higher against the euro. So far, no major global shifts have occurred. Donald Trump's policies may eventually harm the U.S., but traders and investors have not fully realized this. The U.S. dollar can continue to rise based on the same factors we highlighted last year.

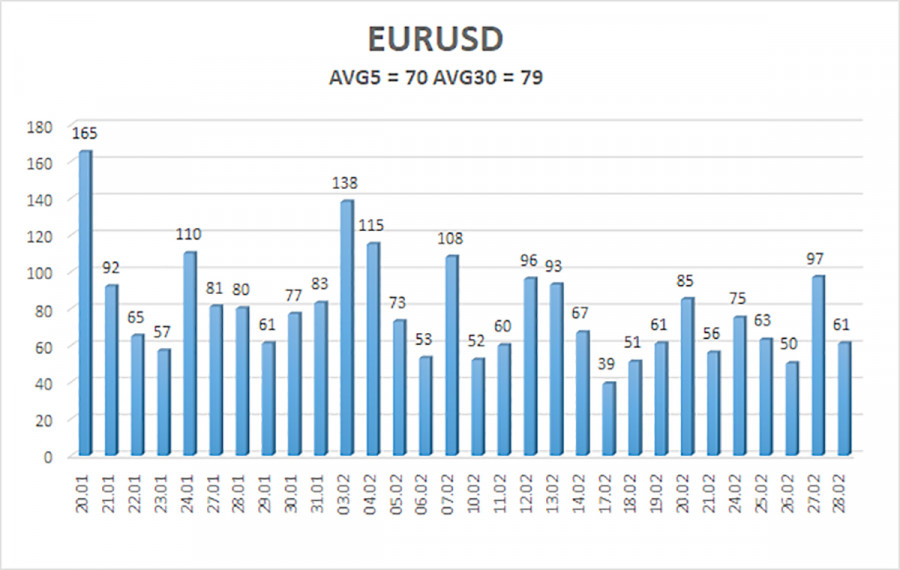

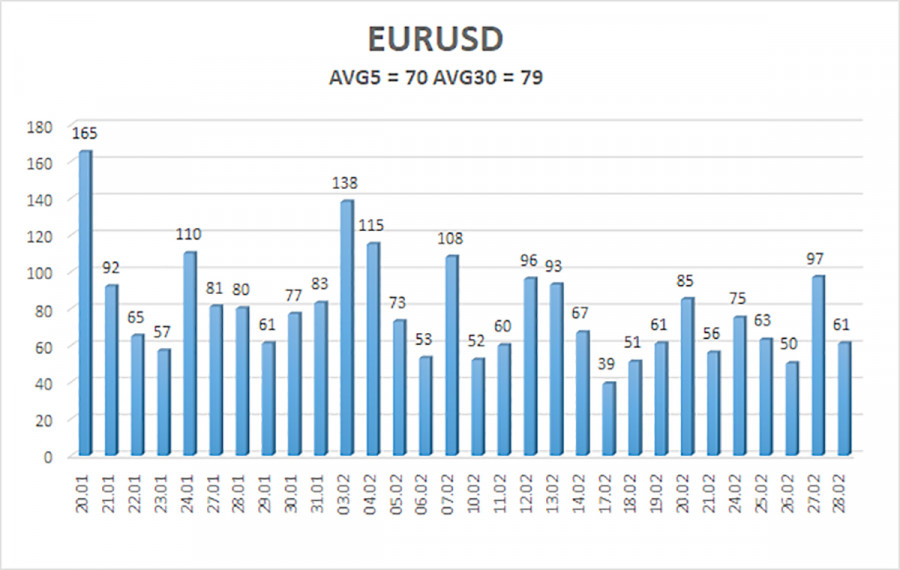

The average volatility of the EUR/USD pair over the last five trading days as of March 3 stands at 70 pips, which is classified as "moderate." We expect the pair to move between 1.0307 and 1.0447 on Monday. The long-term regression channel remains downward, and even if it turns upward, the broader downtrend will not be canceled. The CCI indicator has entered the oversold zone again, but this is irrelevant as the pair remains in a sideways range.

Nearest Support Levels:

S1 – 1.0376

S2 – 1.0315

S3 – 1.0254

Nearest Resistance Levels:

R1 – 1.0437

R2 – 1.0498

R3 – 1.0559

Trading Recommendations:

The EUR/USD pair continues to trade within the 1.0220–1.0520 range. For months, we have consistently stated that we expect only a decline in the euro in the medium term, and nothing has changed. The U.S. dollar still has no reasons for a medium-term decline—except for Donald Trump. Short positions remain much more attractive, with initial targets at 1.0315 and 1.0307. If you trade purely based on technicals, long positions could be considered if the price consolidates above the moving average, with targets at 1.0498 and 1.0559. However, as we can see, the price has not even managed to break out of the sideways range on the daily timeframe. Any upward movement is still classified as a correction on the daily chart.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.