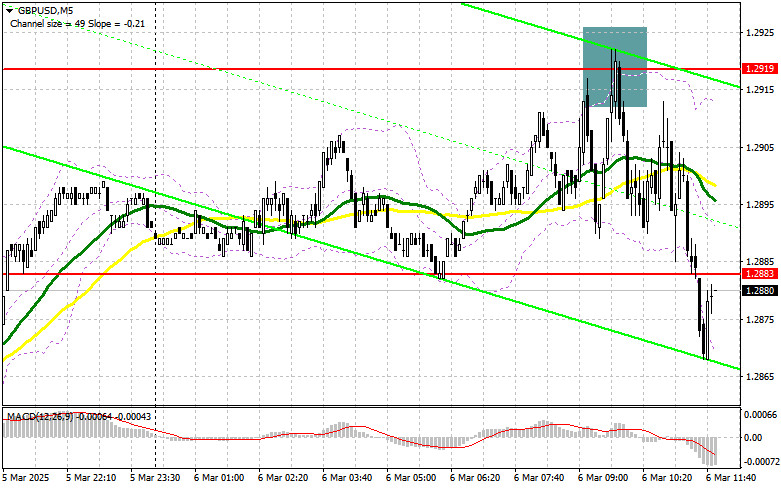

In my morning forecast, I highlighted the 1.2919 level as a key decision point for market entry. A look at the 5-minute chart shows that a false breakout around 1.2919 provided an excellent short entry, leading to a decline of more than 40 points. The technical outlook for the second half of the day has been revised accordingly.

Long Position Strategy for GBP/USD:

Buyers faced resistance around 1.2920, but this seems more due to a lack of new demand at current highs rather than a strong presence of sellers. A series of key U.S. labor market reports is set to be released in the second half of the day. Weak data, similar to yesterday's ADP report, helped revive demand for the pound, and a repeat scenario is possible today. The focus will be on initial jobless claims, labor productivity in the non-manufacturing sector, and unit labor costs. Additionally, FOMC member Christopher Waller is scheduled to speak, with a likely dovish stance on further rate cuts in the U.S. A combination of weak statistics and dovish rhetoric from the Fed could boost demand for the pound and pressure the dollar.

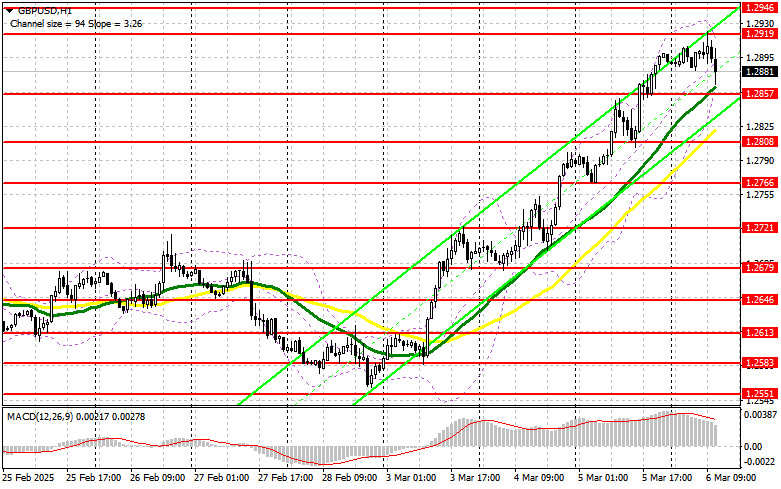

If U.S. data is strong, GBP/USD could fall toward the nearest support at 1.2857. A false breakout at this level would present a solid buying opportunity, targeting a recovery toward resistance at 1.2919. A breakout and retest of this range from above would confirm a new long entry, with the next upward target at 1.2946, further strengthening the bullish trend. The final upward target will be 1.2972, where I plan to take profits.

If GBP/USD declines and buyers fail to show activity around 1.2857 in the second half of the day, bearish pressure on the pound will increase. In this case, I will look for a false breakout around the 1.2807 low as a signal to open long positions. Alternatively, I will consider buying on a direct rebound from support at 1.2766, aiming for a 30-35 point intraday correction.

Short Position Strategy for GBP/USD:

Sellers made a strong impact in the first half of the day, triggering a significant correction in the pound. However, this correction remains minor compared to the broader uptrend that has been in place since the end of last week.

In the second half of the day, focus remains on defending the 1.2919 resistance level. Only strong U.S. labor market data could restore bearish pressure on the pair. A false breakout at 1.2919, similar to the earlier setup, would provide a short entry targeting 1.2857 as an intermediate support level. A breakout and subsequent retest from below would trigger stop-loss orders, clearing the way for a drop toward 1.2808, where moving averages currently favor buyers. The final downward target for short positions is 1.2766, where I will lock in profits. Testing this level could temporarily halt the bullish trend.

If demand for the pound remains strong in the second half of the day and bears fail to defend 1.2919, the pair will likely continue rising. In this case, I will postpone short positions until GBP/USD tests resistance at 1.2946. I will consider selling only if a false breakout occurs there. If the pair continues upward without a pullback, I will look for short entries at 1.2972, aiming for a 30-35 point downward correction.

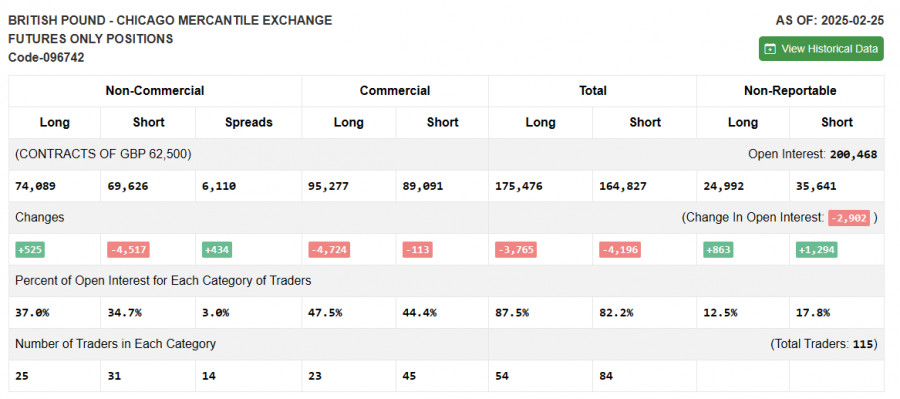

Commitments of Traders (COT) Report:

The COT report for February 25 showed a minimal increase in long positions and a reduction in short positions. The buying advantage over selling is becoming more apparent, increasing the probability of continued GBP/USD growth. Given the positive developments in conflict resolution in Ukraine and relatively stable economic data from the UK, traders continue to show interest in the British pound.

The latest COT report indicates that long non-commercial positions increased by 525, reaching 74,089, while short non-commercial positions decreased by 4,517, totaling 69,626. As a result, the gap between long and short positions widened by 434.

Indicator Signals:

Moving AveragesThe pair is trading above the 30 and 50-period moving averages, signaling further potential for upward movement.

Note: The analysis is based on the hourly (H1) chart, which differs from traditional daily (D1) moving average calculations.

Bollinger BandsIf the pair declines, the lower boundary of the Bollinger Bands at around 1.2857 will act as support.

Indicator Descriptions:

- Moving Averages (MA): Used to identify the current trend by smoothing out price volatility and noise.

- MACD (Moving Average Convergence/Divergence): A momentum indicator that helps assess trend direction and potential reversals.

- Bollinger Bands: A volatility-based indicator that helps identify overbought and oversold conditions.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, who use futures markets for speculative purposes.

- Long non-commercial positions: The total number of long positions held by speculators.

- Short non-commercial positions: The total number of short positions held by speculators.

- Net non-commercial position: The difference between the number of long and short positions held by speculators.