Stock Indices Lose Ground

The U.S. stock market came under pressure on Tuesday, with the S&P 500 and Nasdaq hitting their lowest levels in a month. The main catalyst for the sell-off was a fresh consumer confidence report that highlighted growing economic uncertainty.

Both indices ended the day in the red, marking their fourth consecutive session of decline. The Dow Jones, on the other hand, managed to gain slightly, but the overall trend on the market remains negative.

Consumers Are Losing Confidence

The negative investor sentiment is largely due to a sharp deterioration in consumer confidence. According to the Conference Board, the consumer confidence index in February showed its largest monthly drop since August 2021.

Experts note that American households are increasingly worried about the future of the economy. Of particular concern is the 11.3 percent decline in the short-term expectations component, which is now at a level that traditionally precedes a recession.

"Many companies have already expressed caution about the outlook for consumer spending, and the latest data only confirms these concerns," comments Peter Tooze, president of Chase Investment Counsel.

Political instability is exacerbating the situation

In addition to economic factors, the unstable political situation is also putting pressure on consumers. In particular, concerns about the impact of the Donald Trump administration's policies are growing, which is forcing both businesses and ordinary Americans to act with caution.

"The headlines have been full of drama lately. "People are taking a wait-and-see approach before making major decisions, whether it's a major purchase or an investment," Tooze explains.

As a result, many are putting off buying both consumer goods and stocks, which is only adding to the volatility in the market. Experts warn that the situation could remain tense in the near term if economic and political uncertainty continues to mount.

A measured approach to monetary policy

On Tuesday, Richmond Federal Reserve President Tom Barkin said that the current economic uncertainty requires a measured and measured approach to monetary policy. His words confirmed market expectations: according to LSEG data, investors are pricing in interest rates to remain at current levels for at least the first half of the year.

This signal from the Fed only deepened the sense of uncertainty, forcing market participants to pay even closer attention to macroeconomic indicators and the regulator's next steps.

Growing Market Panic and Bitcoin Crash

Amid rising volatility, the CBOE VIX, known as the "fear index," soared to its highest since January 27. This indicates growing market fears and growing nervousness among investors.

Another worrying signal came from the crypto market: Bitcoin, which is often perceived as a risk indicator, fell sharply by 6.1%. The fall of the digital currency led to a massive sell-off in crypto-related stocks - Coinbase shares fell by 6.4%, and MicroStrategy lost 11.4%.

Mixed dynamics of the stock market

Despite the overall negative background, the Dow Jones Industrial Average managed to add 159.95 points (+0.37%), closing at 43,621.16. However, the broad-based S&P 500 index fell 0.47%, losing 28.00 points to end at 5,955.25. The tech-heavy Nasdaq Composite fell even further, losing 1.35%, losing 260.54 points to end at 19,026.39.

Among the S&P 500 sectors, communications services showed the worst performance, while consumer discretionary was the only one to show solid growth.

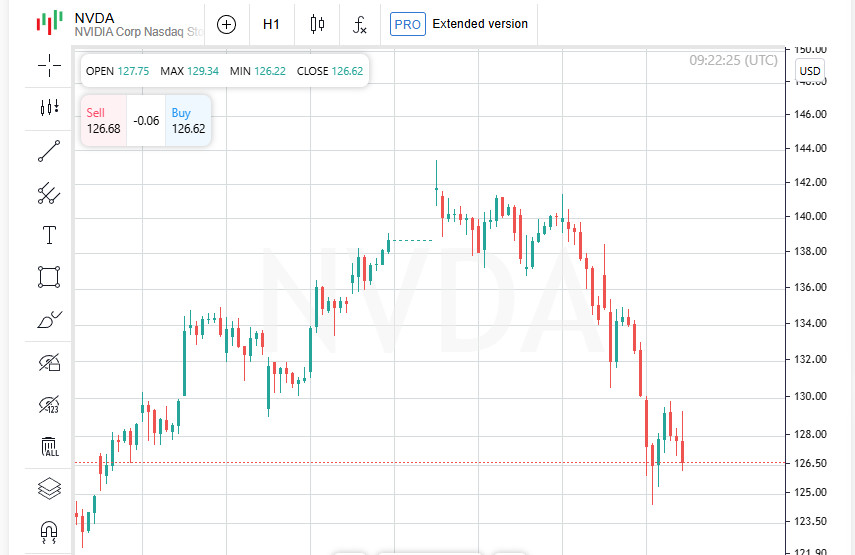

Nvidia in Focus: Investors Hold Their Breath

Nvidia shares are down 2.8% ahead of the company's key quarterly report, due after the close of trading on Wednesday. Investors are eagerly awaiting the data, as Nvidia remains a leading player in the chip and artificial intelligence space.

Adding pressure to the company's stock was news that the United States is planning to tighten export restrictions on Nvidia chips to China. According to Bloomberg, the US authorities intend to limit not only the quantity but also the types of semiconductors that can be exported without a license.

These measures are part of a broader US strategy aimed at curbing China's technological advancement. If new restrictions are introduced, this could seriously hurt Nvidia's revenue, given the high demand for its products in China.

The market remains in a state of uncertainty, as investors monitor signals from the Federal Reserve, economic data, and corporate earnings reports, which could set the direction of the stock market in the coming weeks. The situation on the crypto market, as well as possible restrictions on the export of chips to China, add additional risks.

In the coming days, the key factors for market participants will be:

- Nvidia's financial results;

- New comments from Fed officials;

- The dynamics of consumer sentiment and macroeconomic indicators.

If volatility continues to increase, market participants may switch to "risk aversion" mode, which will lead to a further decline in quotes on the stock and cryptocurrency markets.

Zoom under pressure: investors disappointed with the forecast

Zoom Communications (ZM.O) shares fell by 8.5% after the company presented a disappointing forecast for full-year revenue. Investors expected more optimistic prospects, but cautious growth estimates led to a sell-off in shares.

Zoom, which is looking to expand its presence beyond video conferencing, is facing increasing competition from large tech giants. Slow revenue growth is forcing analysts to revise their forecasts for the company, putting pressure on its market capitalization.

Li Auto soars as new electric SUV creates excitement

At the opposite end of the spectrum, Li Auto's US-listed shares jumped 13.2% after unveiling its first all-electric SUV.

The company, which has previously focused on hybrid models, is now betting on pure electric mobility, which could significantly expand its audience. Investors have welcomed the new product, expecting it to help Li Auto gain a foothold in the fast-growing electric car market dominated by Tesla and BYD.

Pharmaceuticals in Focus: Deals and New Drugs

Shares in pharmaceutical company Eli Lilly (LLY.N) rose 2.3% after news that it has launched a new version of its weight-loss drug Zepbound in the US. The company offers higher-dose vials at a discount compared to previous pen versions.

Demand for weight-loss drugs remains strong, and the new pricing could boost Zepbound's popularity, intensifying competition in a market where Eli Lilly is battling Novo Nordisk.

Meanwhile, Solventum (SOLV.N) shares soared 9.5% after a major deal was announced. Biotech giant Thermo Fisher (TMO.N) said it would buy the company's purification and filtration business for $4.1 billion. The deal highlights the appetite of major corporations for strategic acquisitions in the pharma and biotech space, which is keeping the sector active.

European Markets: Investors Expect Correction Before New Gains

Meanwhile, European stock markets are expected to correct over the next three months before the region's shares resume their growth and reach new all-time highs by 2026.

A survey of investors and analysts found that 54% of respondents expect European stocks to decline by 10% or more, up from 50% in November. After a strong rally at the start of the year, European indices have come close to levels above Wall Street, making a correction likely.

However, the long-term outlook remains optimistic. According to the median forecast, the STOXX 600 index will remain at current levels by the end of 2025, but will reach a record 610 points by mid-2026. This means that a short-term correction could provide investors with an opportunity to enter the market more profitably.

Markets continue to react to corporate earnings, macroeconomic factors and expectations regarding the Fed's policy. Investors are watching the following key events:

- Further developments in Zoom and Li Auto shares;

- Zepbound sales and their impact on the weight loss drug market;

- Possible new deals in the pharmaceutical sector;

- Development of the European stock market and its growth prospects.

The situation remains tense, and the coming weeks may bring new swings in global financial indices.

Euro STOXX 50 may experience a deeper drawdown

After an impressive rise this year, the blue-chip Euro STOXX 50 index (.STOXX50E), which outperformed the broader STOXX 600 market, may face a correction. The main drivers of growth so far have been large European banks such as Santander (SAN.MC), tech giant SAP (SAPG.DE) and the luxury sector. However, analysts are warning of a possible decline in the future.

According to the median forecast, the index could fall by 6.5% by mid-2025, falling from the current level of 5453.76 points to 5325 points by the end of the year. However, a new round of growth is expected in 2026 - by the middle of the year, the index could update its historical maximum, reaching 5725 points.

Fundamentals or emotions?

Some analysts, including Field, believe that the current quotes of European stocks look fair, but further dynamics may depend not so much on the real state of the economy, but on investor sentiment.

At the moment, the STOXX 600 has grown by more than 9%, and the Euro STOXX 50 has added 11% since the beginning of the year. By comparison, the American S&P 500 (.SPX) showed only a 1.7% increase, as the previous excitement around technology stocks began to fade.

2026 Forecasts: Hope for Accelerated Growth

Despite a likely short-term correction, the long-term forecast for European markets remains quite optimistic. In 2026, corporate earnings growth in Europe is expected to accelerate from 7.5% to 11.2%, which will create favorable conditions for the recovery of quotes.

Among the factors that could support the stock market, analysts highlight:

- Low valuations of European assets, which makes them attractive to investors;

- A possible rebound in Chinese markets, which will have a positive effect on export-oriented companies;

- Increasing defense spending, which will support military and industrial corporations;

- Expected interest rate cuts by the European Central Bank, which will improve conditions for business;

- Possible fiscal stimulus measures that can further warm up the economy.

Thus, although the European market may face a correction in the coming months, its long-term prospects remain strong. For strategic investors, the current volatility could provide new opportunities to profitably enter the market before the next stage of growth.

DAX prepares for a decline: German market under attack

Amid uncertainty in the global economy, the German DAX index (.GDAXI), considered one of the main indicators of stability in Europe, could face a decline of more than 4%. It is forecast to fall to 21,455 points by mid-2025, which would be lower than the current levels.

This weakening is caused by a combination of factors: slowing growth in the German economy, instability in the industrial sector and possible consequences of geopolitical tensions. If these trends continue, the index could continue to fall in the coming months.

FTSE 100: London Market Set to Hit a Record

While the German stock market is struggling, the UK's FTSE 100 (.FTSE) is showing steady positive momentum. The index is forecast to reach 8,800 points by mid-2025, and then continue to rise, reaching 9,000 points by mid-2026.

This growth is due to a number of factors, including the strength of energy companies, the resilience of the financial sector and stable demand for assets with high dividend payments.

Italy and Spain: Growth with a Possible Correction

The Italian FTSE Mib (.FTMIB) is also among the promising European indices, demonstrating strong growth throughout 2024. Experts believe that it will continue its positive momentum in 2025, making it attractive to investors focused on European assets.

France's CAC 40 (.FCHI) and Spain's IBEX (.IBEX) are expected to continue rising through mid-2025, but could experience a correction in the second half of that year. This is due to expectations of slower corporate earnings growth and possible changes in monetary policy.

STOXX 600 remains undervalued compared to the S&P 500

Despite the current volatility and possible corrections, the European market remains attractive from an asset valuation perspective. According to LSEG Datastream, the STOXX 600 index trades at a historical discount of 36% compared to the US S&P 500 on a 12-month forward P/E basis.

This valuation gap could be a catalyst for capital inflows into European equities, especially if the macroeconomic environment improves and monetary policy is eased by the European Central Bank.

European markets will remain in investors' focus in the coming months, especially given the expected changes in central bank policy and the geopolitical situation.

- Germany's DAX may continue to decline, making it a risky asset in the short term;

- London's FTSE 100 and Italy's FTSE Mib are showing strong growth, creating favorable conditions for investors;

- France's CAC 40 and Spain's IBEX are still growing, but may roll back in 2025;

- The European market remains undervalued, which may become the basis for a future rebound.

Further dynamics will depend on macroeconomic data, central bank decisions and corporate reports, which may adjust the forecasts for the coming years.